When you’re retired, it’s natural to look for ways to boost your income without taking on extra risk. You’ve already done the hard part—saving and investing for years. Now it’s about making your money work smarter. One powerful (and surprisingly conservative) strategy that many retirees are starting to use is covered calls.

At first glance, covered calls might sound complex or even risky—but when used correctly, they can be a safe and steady way to generate extra cash from stocks you already own. Think of it as renting out your stocks for a bit of extra income.

Let’s break down how covered calls work, why they’re safer than you might think, and how you can start using them in a way that fits a retirement lifestyle. We’ll also walk through two real-life examples to make everything crystal clear.

What Is a Covered Call?

A covered call is an options strategy that allows you to earn extra income from stocks you already own.

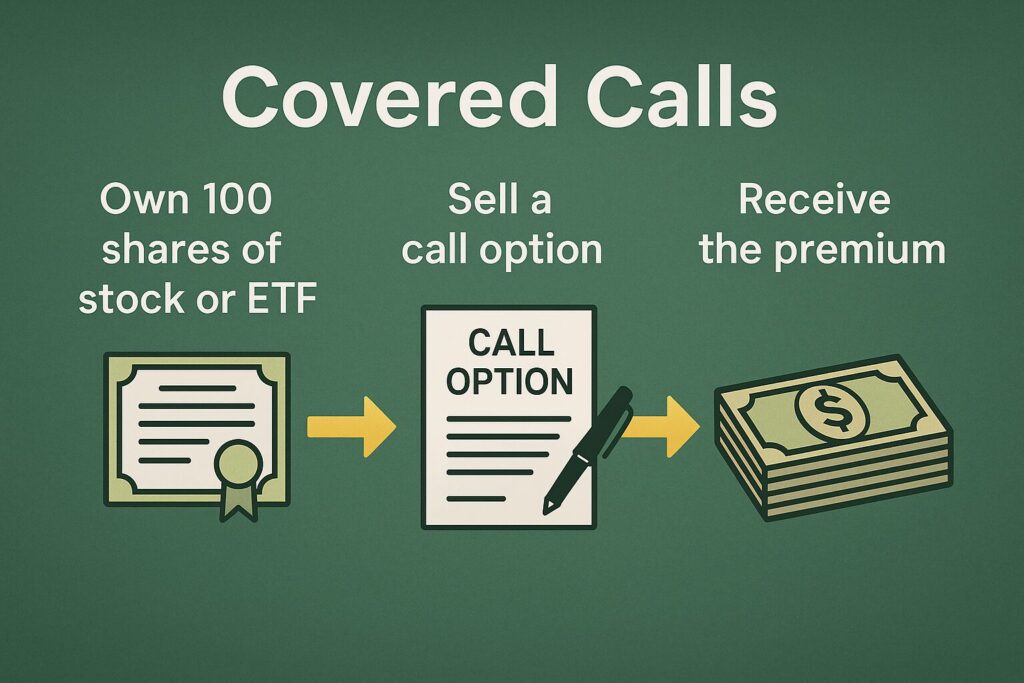

Here’s how it works in simple terms:

- You own at least 100 shares of a stock (or ETF).

- You sell a call option on those shares.

- In exchange, you receive a cash premium (upfront income).

- The buyer of the call option has the right (but not the obligation) to buy your shares at a certain price (called the strike price) before the option expires.

If the stock stays below that strike price, you keep your shares and the cash you earned. If the stock rises above the strike price, your shares may be called away (sold), but you still keep the cash from selling the option plus the gain on your shares.

It’s a win-win scenario when used properly.

Why Covered Calls Can Be Perfect for Retirees

Covered calls are one of the few strategies that allow you to earn steady income without selling your stocks or taking wild risks. Here’s why retirees love them:

- ✅ Monthly or quarterly income: Get paid regularly just for owning your shares

- ✅ Simple and safe: You’re not buying anything risky—you’re using what you already own

- ✅ Reduced downside risk: The premium you receive cushions small market drops

- ✅ Perfect for slow-growing stocks or ETFs: Make money even if your stock doesn’t move much

- ✅ Fits well into income planning: Use the extra income to help pay for everyday expenses

Now let’s see how this plays out in real life.

Real-Life Example #1: Linda’s Safe Income from Utility Stocks

Linda, a 70-year-old retiree, owns 500 shares of Duke Energy (DUK), a utility stock she’s held for years. It pays a nice dividend, but she’d like to increase her income without taking on more risk.

She learns about covered calls and decides to give it a try.

- Stock Price: $95 per share

- She sells one call option per 100 shares (so five contracts total)

- Strike Price: $100 (meaning she agrees to sell at $100 if the buyer wants)

- Expiration: One month

- Premium earned: $1.50 per share (or $150 per contract × 5 = $750 total)

Here’s what happens:

- If DUK stays below $100, Linda keeps her shares and the $750 in cash.

- If DUK rises above $100, her shares might get sold at $100 each. She still keeps the $750 premium, plus the $5 per share gain ($100 − $95).

In either case, she wins. She’s earned hundreds in income just by “renting” her stock temporarily. And she can do it again next month if she wants.

Real-Life Example #2: Robert Uses ETFs to Boost Income

Robert, age 68, prefers exchange-traded funds (ETFs) because they offer instant diversification. He owns 1,000 shares of the SPDR S&P 500 ETF (SPY) as part of his core retirement portfolio.

He doesn’t want to sell his shares but is looking for extra monthly income. So he starts writing covered calls on 500 shares—just half his position—to stay conservative.

- SPY Price: $500 per share

- Strike Price: $515

- Premium earned: $3.00 per share

- Income for the month: $3.00 × 500 = $1,500

If SPY rises past $515, those 500 shares may get sold—but Robert keeps the $1,500 premium and a $15 per share profit on the sale. If SPY stays below $515, he keeps all the shares and repeats the process the next month.

By using a well-diversified ETF and only a portion of his holdings, Robert gets the best of both worlds: growth and income.

Key Tips for Using Covered Calls Safely

If you’re ready to try covered calls in retirement, here are a few simple tips to stay on the safe side:

✔ Only Use Stocks or ETFs You’re Happy to Hold

Covered calls are most effective when you write them on stable, dividend-paying stocks or ETFs. Don’t use risky or speculative stocks.

✔ Choose Strike Prices Above the Current Market Price

That way, you earn income without being forced to sell your shares too soon.

✔ Stick to Short Expiration Dates (Monthly is Ideal)

Shorter time frames give you more flexibility to adjust or take advantage of new opportunities.

✔ Don’t Overdo It

You don’t have to use this strategy on every stock you own. Start small—maybe one position—and grow from there.

✔ Consider Covered Call ETFs

If you’d rather not manage the strategy yourself, funds like JEPI or QYLD do it for you and pay high monthly income.

What Could Go Wrong?

Covered calls are considered one of the least risky options strategies, but no investment is completely without risk.

Here are two things to be aware of:

- Your stock might get called away. If the price jumps above your strike, you could miss out on further gains (though you still make a profit).

- If the stock drops sharply, your premium helps—but it won’t prevent losses. Covered calls cushion small dips, not big crashes.

That’s why this strategy is best paired with stable, dividend-paying stocks—not volatile or speculative ones.

Final Thoughts: A Smarter Way to Earn More in Retirement

You worked hard to build your retirement portfolio—now it’s time to make that portfolio work for you.

Covered calls are a conservative, income-focused strategy that retirees can use to boost their income without chasing risky investments. Whether you’re writing calls on reliable stocks like Duke Energy or on ETFs like SPY, you can safely add hundreds—or even thousands—of dollars a year to your income stream.

Think of it as “bonus income” from the shares you already own.

And the best part? You’re in control. You choose the strike price. You choose the timing. And if you want to keep your shares forever, you can just write calls slightly above the current price and collect steady cash without ever selling.

Disclaimer: For Educational Purposes Only

The content on this website is intended for general educational use and should not be considered personalized financial, legal, or tax advice. Always consult a qualified professional before making financial decisions. All investments carry risk, and past performance is not a guarantee of future results. The author assumes no liability for actions taken based on this content.