Create Peace of Mind With These Essential Papers

As we get older, it’s natural to start thinking more about the future—especially how to protect ourselves and our loved ones if something unexpected happens. Having the right legal documents in place isn’t just about being prepared—it’s about having peace of mind.

Whether you’re 65 or 85, these legal documents can help you stay in control, safeguard your wishes, and ease the burden on your family.

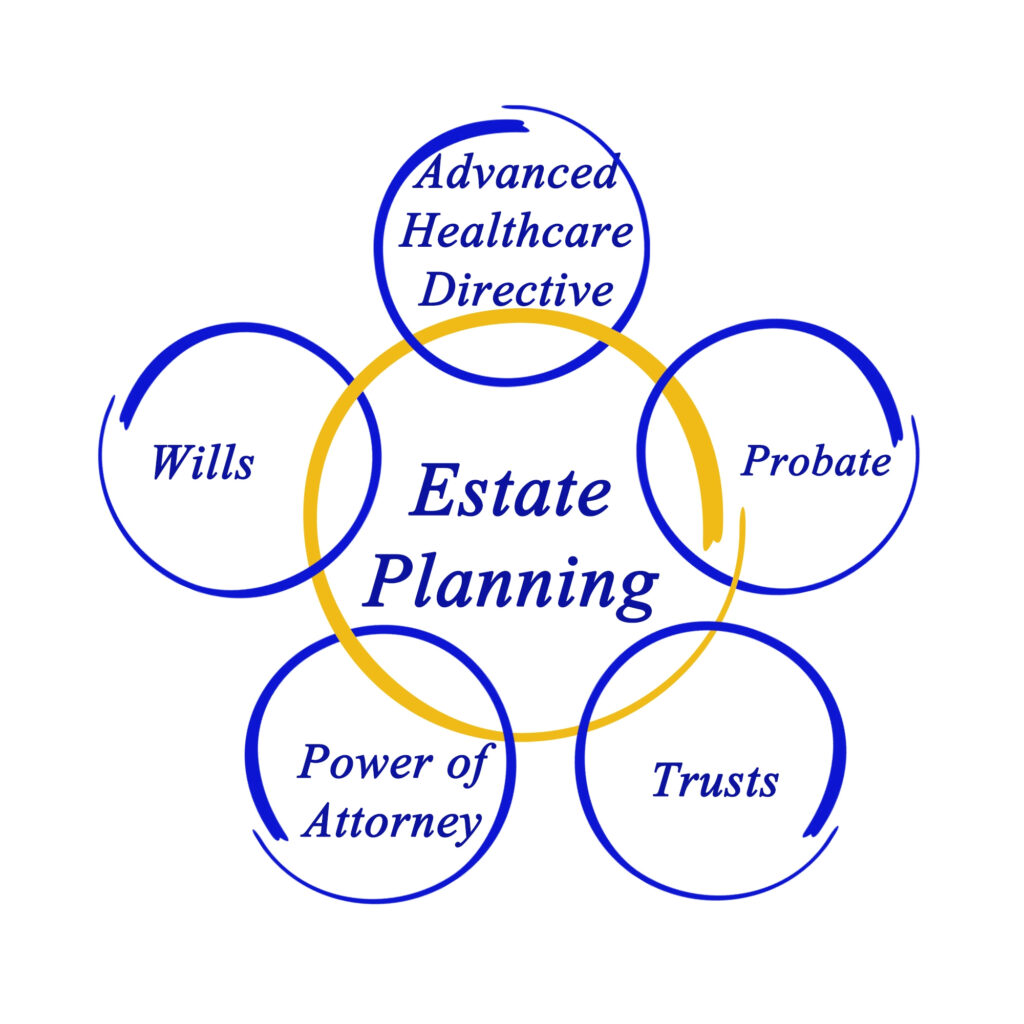

Here’s a quick guide to the most important legal documents every retiree should have.

1. Last Will and Testament

A will is the cornerstone of any estate plan. It outlines:

- Who will receive your assets

- Who will serve as the executor of your estate

- Guardianship decisions (if needed for dependents)

Without a will, your estate could be tied up in probate for months—or even years—leaving loved ones with confusion and potential disputes. A clear, legally valid will ensures your final wishes are honored and makes things far easier for your family during an already difficult time.

2. Durable Power of Attorney (POA)

A durable power of attorney lets you name someone you trust to handle your financial matters if you become unable to do so.

This includes:

- Managing bank accounts

- Paying bills

- Handling investments or real estate

- Filing taxes

It’s called “durable” because it stays in effect even if you become incapacitated. Without it, your loved ones might have to go to court to be appointed as your guardian—an expensive and time-consuming process that can easily be avoided.

3. Medical Power of Attorney (Healthcare Proxy)

This document allows someone you trust to make medical decisions for you if you’re unable to speak for yourself.

This person—often a spouse or adult child—can talk to your doctors, make treatment decisions, and ensure your healthcare preferences are followed.

It’s essential to have these conversations in advance. That way, your proxy won’t have to guess about what you’d want.

4. Advance Directive (Living Will)

An advance directive—sometimes called a living will—lets you clearly state what kinds of medical care you do or don’t want if you become terminally ill or permanently unconscious.

Examples include:

- Whether you want to be kept alive on a ventilator

- If you want artificial nutrition or hydration

- Whether you want CPR or resuscitation

It takes a huge burden off your loved ones during medical crises and helps ensure your values and wishes are respected.

5. HIPAA Authorization

This simple but important document allows the people you name to access your medical information and speak to your healthcare providers.

Without it, even your spouse or adult children may be blocked from getting updates about your condition due to strict privacy laws.

It works hand-in-hand with your medical power of attorney.

6. Revocable Living Trust (Optional but Worth Considering)

While not necessary for everyone, a revocable living trust can be especially useful for retirees who want to:

- Avoid probate

- Maintain privacy

- Provide for heirs in a controlled way (e.g., staggered inheritance)

You transfer assets (like your home, bank accounts, and investments) into the trust during your lifetime, and name a trustee to manage those assets if you become incapacitated or pass away.

Talk with an estate planning attorney to see if a trust makes sense for your situation.

Peace of Mind for You—and Your Family

These documents aren’t just legal formalities. They’re powerful tools that help you:

- Stay in control of your affairs

- Protect your assets

- Make life easier for the people you love

Putting these documents in place doesn’t take forever or cost a fortune—and it’s one of the smartest steps you can take in retirement.

If you haven’t already, consider meeting with an estate planning attorney to get your paperwork in order. And if you created these documents years ago, now might be the perfect time for a quick review to ensure they still reflect your current wishes.

Disclaimer:

This post is for informational purposes only and is not intended to provide legal advice. Always consult with a qualified attorney who specializes in estate planning to ensure your legal documents comply with your state laws and reflect your personal wishes.

Having the right paperwork is one of the kindest gifts you can leave your loved ones. Don’t put it off—get started today and enjoy the peace of mind that comes with being prepared.