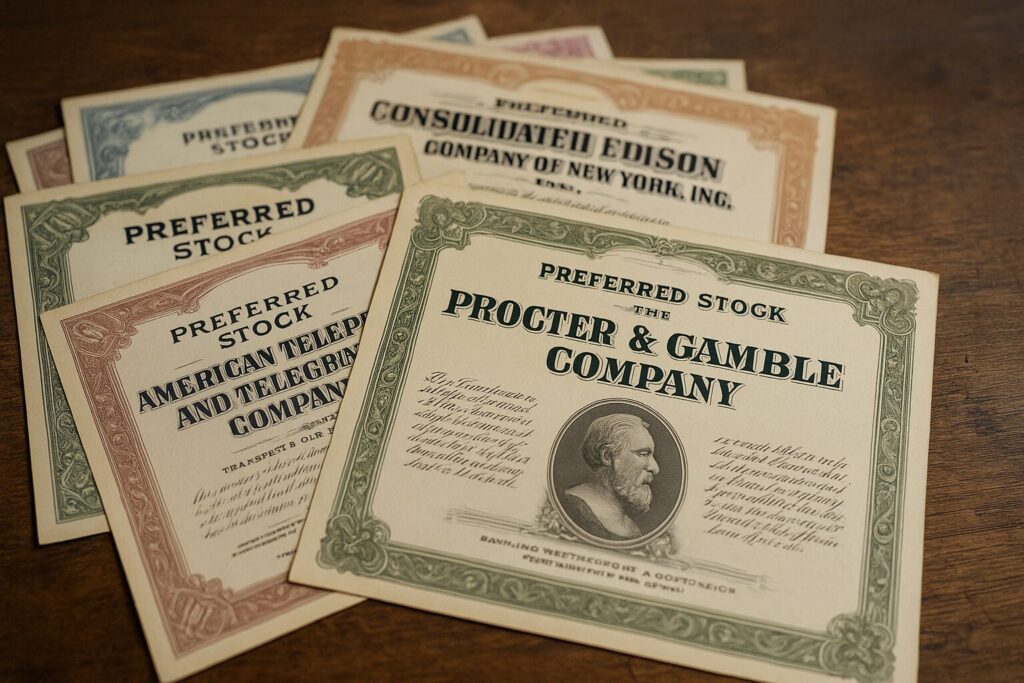

Get exposure to dozens of preferred shares in one click.

If you’re searching for a simple yet powerful way to collect income in retirement, Preferred Stock ETFs could be just the ticket. These funds bundle dozens—sometimes hundreds—of preferred shares into one easy-to-buy investment that trades like a stock. That means you get steady dividends, diversification, and liquidity—all in one click.

In this post, we’ll compare the top six preferred stock ETFs, explore their key strengths, and highlight their long-term performance trends. Let’s dive in.

🏆 Top 6 Preferred Stock ETFs

Here are six leading ETFs that specialize in preferred shares, along with a snapshot of their strategies and performance:

1. iShares Preferred and Income Securities ETF (PFF)

- Yield: ~6.7%

- Expense Ratio: 0.46%

- Assets: ~$13.6 billion

- Summary: Tracks a broad index of preferred securities. Offers massive liquidity and a diversified pool of over 400 holdings. It’s one of the largest and most trusted options in the space.

2. Invesco Preferred ETF (PGX)

- Yield: ~6.2%

- Expense Ratio: 0.50%

- Assets: ~$3.85 billion

- Summary: Focuses on investment-grade issuers, providing a mix of quality and steady monthly income. A long-time favorite for conservative income seekers.

3. SPDR Wells Fargo Preferred Stock ETF (PSK)

- Yield: ~6.1%

- Expense Ratio: 0.45%

- Assets: ~$1.5 billion

- Summary: Uses a sector-based index that caps exposure to any single issuer. This can reduce concentration risk and appeal to investors looking for better diversification.

4. Global X U.S. Preferred ETF (PFFD)

- Yield: ~6.4%

- Expense Ratio: 0.23%

- Assets: ~$2 billion

- Summary: A low-cost, passive fund that holds over 200 preferred securities. Offers solid income and diversification at one of the lowest expense ratios in the category.

5. First Trust Preferred Securities & Income ETF (FPE)

- Yield: ~5.8%

- Expense Ratio: 0.85%

- Assets: ~$5.9 billion

- Summary: Actively managed fund that includes preferreds and convertibles. It aims to boost returns with strategic positioning and has performed well in market recoveries.

6. SPDR ICE Preferred Securities ETF (SPFF)

- Yield: ~6.3%

- Expense Ratio: 0.48%

- Assets: ~$139 million

- Summary: A smaller ETF focused on high-yield preferreds, while still maintaining a majority of investment-grade holdings. Offers elevated income potential with an eye on credit quality.

📈 Long-Term Performance Snapshot

- PFF and PGX have delivered consistent 6–7% yields over the past decade, though they saw price declines in rising-rate environments like 2022.

- FPE stood out with double-digit total returns during recovery periods, thanks to active management and flexible strategy.

- PFFD and SPFF have provided solid results at lower cost, giving investors a good balance of income and efficiency.

- PSK tends to show more stability due to its risk-limiting structure.

🛡️ Which ETF Is Right for You?

✔ For highest yield with active strategy: Choose FPE if you’re comfortable with a higher fee in exchange for potential outperformance.

✔ For liquidity and scale: PFF is the largest fund in the category, great for buy-and-hold investors who want steady income with easy trading.

✔ For cost-conscious investors: PFFD offers low fees and a solid yield, making it a great core holding.

✔ For investment-grade exposure: PGX filters out lower-rated securities, which may help during downturns.

✔ For cautious diversification: PSK reduces the chance of a single issuer dragging down performance.

✔ For yield hunters: SPFF provides enhanced income with a reasonable balance of risk.

💡 Tips for Investing in Preferred Stock ETFs

- Don’t chase yield blindly. Look at the underlying quality and how the fund performed during tough times like 2020 and 2022.

- Diversify. Consider owning more than one ETF or pairing with other asset classes (e.g., bonds or dividend stocks).

- Use in tax-advantaged accounts. Because preferred dividends are often taxed as ordinary income, IRAs or Roths can be a smart choice.

📘 Final Thoughts

Preferred stock ETFs can offer retirees stable monthly income, attractive yields, and diversified exposure to preferred securities without the hassle of picking individual stocks. Whether you’re after simplicity, cost efficiency, or higher income, there’s a fund that fits.

As with any investment, be sure to align your choices with your personal risk tolerance and income needs.

📘 This post is adapted from my book:

9% Retirement Paycheck: How to Generate Steady, Worry-Free Income for Life

Available now at Amazon.com in paperback and eBook formats.

Disclaimer: This article is for informational purposes only and does not constitute financial, investment, or tax advice. All investments carry risk, and past performance is not a guarantee of future results. Please consult a licensed financial advisor before making any investment decisions.