Why This Assumption Can Backfire—And How to Plan for What You’ll Really Spend

Welcome to “Money Myths Retirees Still Believe”—a blog series that uncovers the hidden beliefs that can quietly sabotage your financial peace of mind.

Many retirees cling to common money myths that seem true but can lead to poor decisions, lost income, or unnecessary worry. Each post in this series explores one myth—like “cash is trash” or “I need to beat the market”—and replaces it with a smarter, simpler mindset.

If you’re retired or nearing retirement, this series will help you reassess your approach and feel more confident about your financial future.

The Myth: “I’ll Just Spend Less in Retirement”

When Jim and Carol sat down to estimate their retirement expenses, they came up with a modest number. “We won’t need much,” Jim said. “No more commuting, no more suits, no more business lunches. We’ll just live simply and spend less.”

That worked—at first.

Then the roof needed replacing. Their grandchild needed help with college. Jim developed a chronic health condition. Before long, their “simple lifestyle” was costing more than they planned.

They had bought into a common—and risky—assumption:

👉 That they could simply “cut back” and make retirement work on less.

But real-life retirement isn’t always that tidy.

Why This Myth Sounds So Reasonable

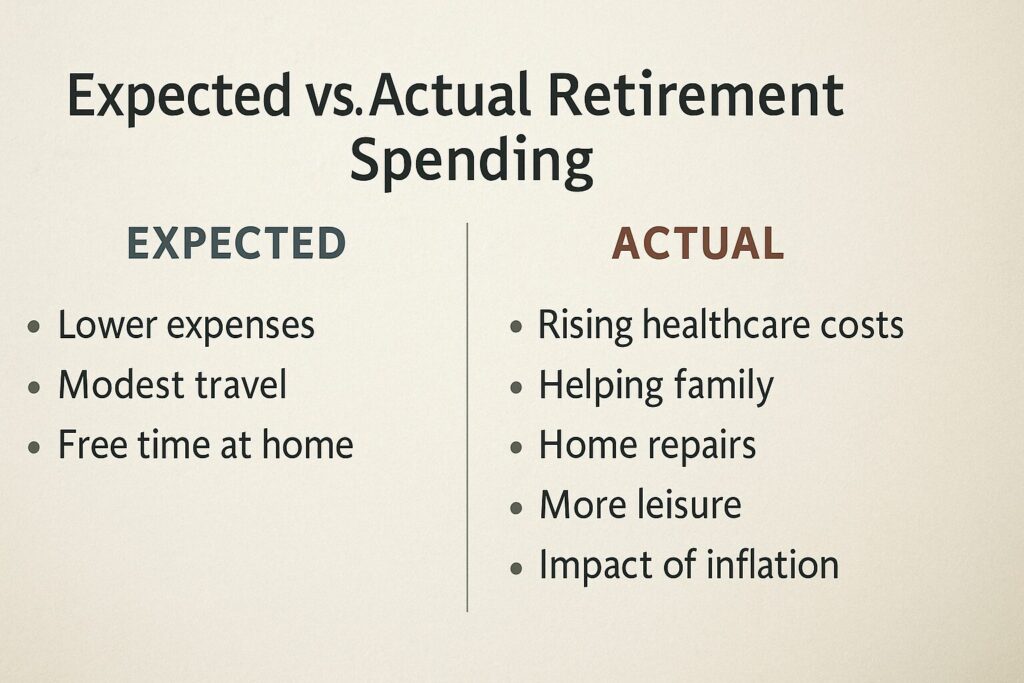

It’s easy to believe:

- You won’t be working, so you’ll have more free time at home.

- Your house might be paid off.

- You’ll eat out less and travel modestly.

- You won’t need to buy work clothes or pay payroll taxes anymore.

And sure, some expenses may go down.

But others often go up—especially as you age.

Where Retirement Spending Really Goes

Here are a few areas where retirees commonly underestimate costs:

💳 Healthcare

Even with Medicare, you’ll face premiums, copays, dental, vision, and out-of-pocket expenses. The average 65-year-old couple may need $300,000 or more for healthcare over their retirement years.

🏠 Home Maintenance

Roofs, plumbing, heating systems, and landscaping don’t care whether you’re retired. As you age, you may also need modifications—like ramps, walk-in tubs, or home health equipment.

🧳 Travel and Leisure

You finally have time for the things you’ve put off—but they cost money. Visiting family, taking trips, or enjoying hobbies all add up.

👨👩👧 Family Support

Helping kids with down payments, grandkids with college, or a sibling with caregiving needs? These generous gestures can put a strain on your nest egg.

📈 Inflation

The same cart of groceries that costs $100 today could cost $140 ten years from now. A fixed income won’t stretch as far unless it grows with inflation.

A Smarter Mindset: Plan for Flexibility, Not Austerity

Rather than hoping to “spend less,” smart retirees plan for a spending curve that changes over time:

✅ Early Retirement (60s–early 70s)

You’re healthy, active, and spending on travel, dining out, and fun. These are often your highest-spending years.

✅ Mid Retirement (70s–80s)

You may slow down a bit, reduce travel, but spend more on healthcare and home services.

✅ Late Retirement (80s–90s+)

Spending may taper off—unless you need long-term care, which can be very expensive.

A Real-Life Example

Debbie thought she could live on $3,000 a month in retirement. And for a few years, she did. But when her car broke down and her daughter needed help with child care, her expenses jumped. She had to take more from her IRA than expected—and triggered a bigger tax bill.

Now, she’s adjusted her approach:

- She keeps a cash buffer for big expenses.

- She set up a flexible withdrawal plan based on real needs.

- She uses a conservative spending estimate—and builds in room for surprises.

“It’s not about being frugal,” she says. “It’s about being ready.”

How to Plan for Real-Life Spending

Here’s how to better prepare:

✅ Track your current expenses—then adjust for retirement changes (health insurance, commuting, dining, etc.).

✅ Use a 3-phase spending model (early, middle, late) to map your needs.

✅ Plan for inflation—assume your expenses will rise by 2–3% per year.

✅ Build in “fun money”—so you don’t feel guilty enjoying life.

✅ Include a healthcare cushion—and consider long-term care insurance or other protection.

✅ Revisit your plan annually—your spending will evolve, and your plan should too.

The Takeaway

Yes, you may choose to spend less in retirement—but don’t assume you can spend less forever.

Unexpected costs, rising prices, and family obligations can throw off even the simplest plans.

Instead of relying on thrift, rely on realistic planning.

Budget for what retirement really looks like—not just what you hope it will look like.

That way, you’ll spend confidently—not cautiously.