What retirees really need to know about this misunderstood income tool

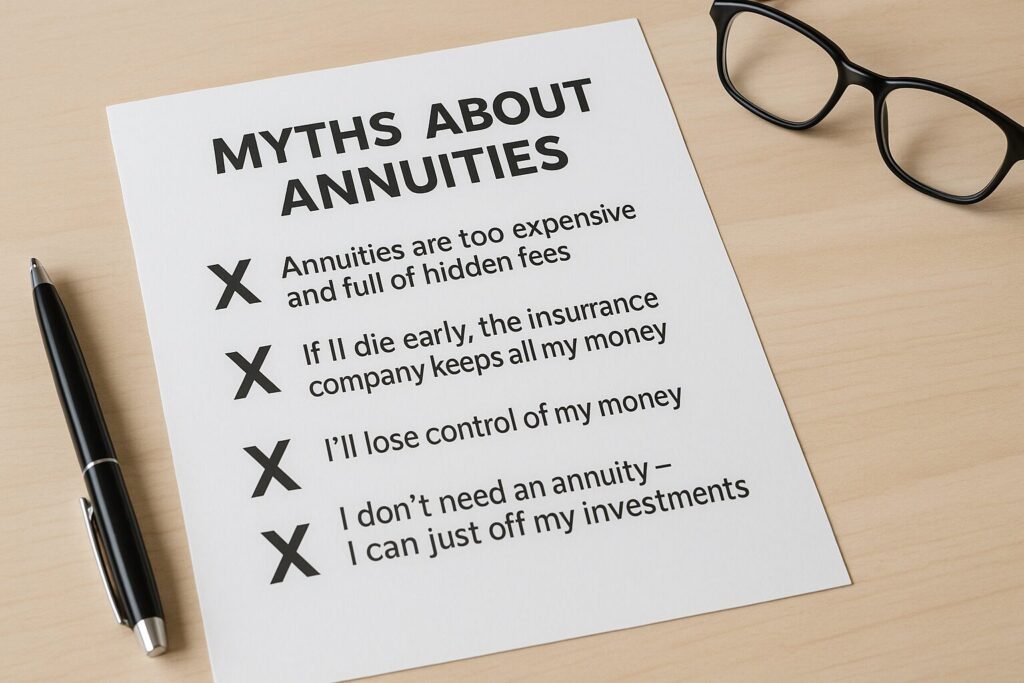

Annuities have a reputation problem.

For years, they’ve been labeled “complex,” “expensive,” or even “scams” by headlines and financial influencers. As a result, many retirees overlook them—despite the fact that annuities can offer one of the safest, most dependable sources of lifetime income in retirement.

But are these fears justified?

In this post, we’ll bust the four biggest myths about annuities, explain what’s fact and what’s fiction, and help you understand when an annuity might actually be the best move for your retirement income plan.

🔍 Myth #1: “Annuities are too expensive and full of hidden fees.”

The Truth: Some annuities have fees—but not all. And the ones that do can still provide excellent value if used correctly.

It’s true that variable annuities often come with higher fees—mortality and expense charges, administrative fees, and investment management fees can easily total 2% or more per year.

But fixed annuities (especially single premium immediate annuities, or SPIAs) and many fixed indexed annuities have low or no annual fees. You’re simply exchanging a lump sum today for guaranteed income tomorrow.

✅ Real-Life Example:

Mary, a 68-year-old widow, wanted to turn $100,000 of her savings into guaranteed income. She bought a fixed immediate annuity that pays her $580 per month for life—no fees, no fuss, just income she can count on.

If you’re concerned about fees, skip variable annuities and focus on fixed and income-focused options instead.

🔍 Myth #2: “If I die early, the insurance company keeps all my money.”

The Truth: Only true if you choose the wrong payout option.

This myth comes from a misunderstanding about how annuities work. Yes, with a life-only annuity, payments stop when you pass away—even if that happens shortly after you buy it. But that’s just one option.

Most annuities offer a range of payout choices:

- Life with 10- or 20-year period certain – Guarantees payments for a minimum number of years, even if you die early.

- Joint-and-survivor – Keeps paying as long as you or your spouse is alive.

- Refund options – Ensure that if you die early, any unused premium goes to your beneficiaries.

✅ Real-Life Example:

Carl and Sandra, both 70, bought a joint life annuity with a 10-year period certain. Even if they both passed away in year two, the annuity would continue payments to their heirs for the remaining eight years. That gave them peace of mind—and guaranteed income they could never outlive.

🔍 Myth #3: “I’ll lose control of my money.”

The Truth: Some annuities are permanent income commitments—but others offer full or partial access to your funds.

This myth stems from older annuity products that required a full “annuitization”—converting your lump sum into income payments with no access to your original investment.

Today’s annuities are much more flexible:

- Deferred fixed annuities allow penalty-free withdrawals after a few years.

- Indexed annuities offer growth potential plus income guarantees—with access to a portion of your money each year (typically 10%).

- Some annuities include guaranteed lifetime withdrawal benefits (GLWBs), allowing you to keep your account balance while still receiving lifetime income.

✅ Real-Life Example:

Susan, 66, put $200,000 into a fixed indexed annuity with a lifetime income rider. She draws $10,000 per year in income starting at age 70, and if she ever needs extra funds, she can still access a portion of the account value without penalty.

Bottom line: If flexibility is important, choose an annuity with withdrawal options.

🔍 Myth #4: “I don’t need an annuity—I can just live off my investments.”

The Truth: Even a well-diversified portfolio can be risky if markets turn or you live longer than expected. An annuity can help fill in the gaps.

Living off stocks and bonds may work—for a while. But market volatility, unexpected expenses, or living longer than planned can throw even the best-laid retirement plan off course.

Annuities provide:

- Guaranteed income for life

- Protection against outliving your money

- Reduced reliance on market performance

Think of an annuity as your personal pension—a way to ensure your basic expenses are covered no matter what happens in the market.

✅ Real-Life Example:

Tony, a retired engineer, used part of his 401(k) to buy an annuity that covers his mortgage, groceries, and utility bills. Now, he invests the rest of his portfolio with more confidence, knowing his essential needs are guaranteed for life.

So, When Does an Annuity Make Sense?

Annuities aren’t for everyone. But they can be ideal for retirees who want:

- A guaranteed monthly paycheck that lasts as long as they live

- A supplement to Social Security or a small pension

- Peace of mind in volatile markets

- Simplicity in managing income over 20–30 years of retirement

You don’t have to put all your money into an annuity. Even using just 20–40% of your savings to secure a base layer of income can reduce stress and increase confidence in retirement.

Final Thoughts: Don’t Let Myths Steal Your Peace of Mind

Annuities have changed. Today’s options are more flexible, more affordable, and more useful than ever before. Don’t let outdated myths prevent you from exploring how an annuity could help you live with more confidence—and less financial worry—in retirement.

If you want guaranteed income that lasts as long as you do, it’s time to give annuities a second look.

📘 Want to dive deeper? My book, Lifetime Income: The Senior’s Guide to Annuities, explains annuities in plain English, helps you choose the right type, and shows how to avoid common pitfalls. Available now at Amazon in paperback and eBook formats.

Disclaimer: This blog post is for educational purposes only and does not constitute financial advice. Always consult with a licensed financial advisor or insurance professional before purchasing an annuity. Annuities are long-term contracts and may involve fees, surrender charges, and other conditions. Guarantees are based on the claims-paying ability of the issuing insurance company.