Still working part-time or funding an IRA? You might get a tax credit for saving — even after you retire.

Most people assume the Saver’s Credit (also known as the Retirement Savings Contributions Credit) is just for younger workers. But if you’re retired and still working part-time — or making contributions to a Traditional or Roth IRA — you may still qualify.

This often-overlooked credit is like a bonus for retirement savers, reducing your tax bill just for setting aside money for your future.

Let’s explore how it works, who qualifies, and how you can claim it — even after you’ve started your retirement journey.

✅ What Is the Saver’s Credit?

The Saver’s Credit is a tax credit of up to $1,000 per person ($2,000 for married couples) for contributing to a qualified retirement account, such as:

- A Traditional or Roth IRA

- A 401(k), 403(b), or 457(b) through part-time work

- A SIMPLE or SEP IRA (if you’re self-employed)

Unlike a deduction, which lowers your taxable income, a credit reduces your actual tax owed — dollar for dollar.

✅ Who Can Qualify?

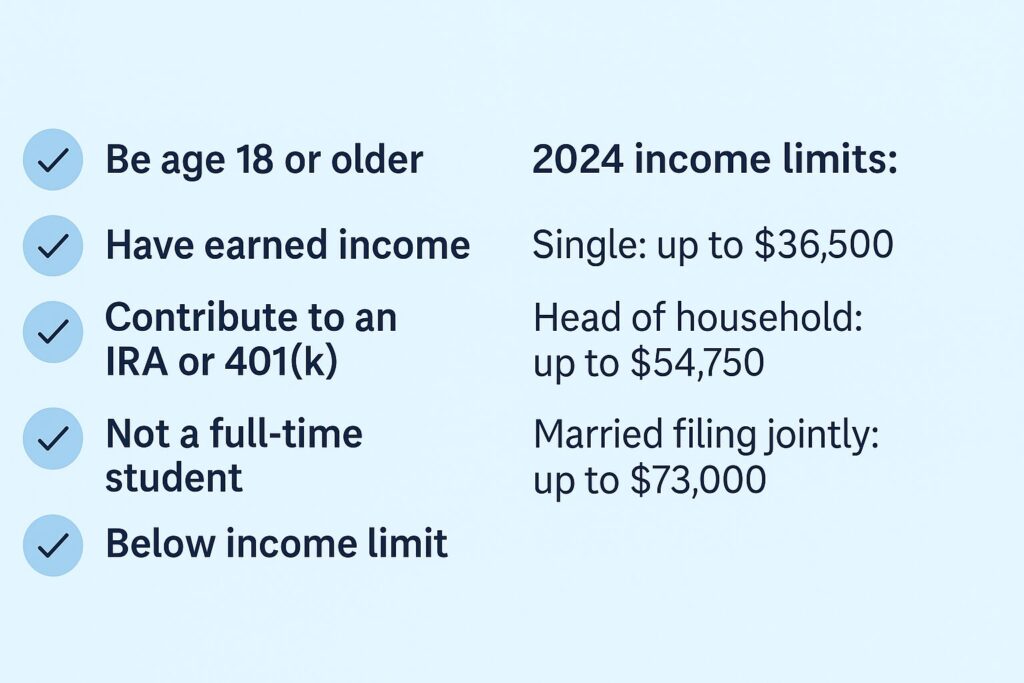

To claim the Saver’s Credit in 2024, you must:

- Be age 18 or older

- Not be claimed as a dependent on someone else’s tax return

- Not be a full-time student

- Have earned income

- Contribute to a qualifying retirement account

- Fall below certain income thresholds:

2024 Saver’s Credit income limits:

- Single filers: up to $36,500

- Head of household: up to $54,750

- Married filing jointly: up to $73,000

So yes — if you’re retired but working part-time at a grocery store, consulting, or even running a small side business — and you contribute to an IRA, you may be eligible.

🧓 Real-Life Example: John and Linda’s $400 Credit

John, 67, and Linda, 65, are retired but earn a combined $25,000 from part-time work. To reduce their future RMDs and taxes, they each contribute $1,000 to a Traditional IRA.

Because their income is well below the threshold, they qualify for a 20% Saver’s Credit, which gives them $400 off their tax bill—just for saving for retirement.

It’s free money for something they were already planning to do.

✅ How Much Is the Credit?

The credit is worth 10%, 20%, or 50% of your contributions, depending on your income level. The maximum is:

- $1,000 per person

- $2,000 per couple

For example:

- Contribute $2,000 and qualify for the 50% rate? Get a $1,000 credit.

- Contribute $1,000 and qualify for the 20% rate? Get a $200 credit.

✅ Tip: You must use IRS Form 8880 when filing your taxes to claim the credit.

✅ Why It’s Worth Exploring

Many retirees don’t realize they still qualify:

- You’re working part-time? That’s earned income.

- You made a late-in-the-year IRA contribution? You may be eligible.

- You file jointly with modest income? You could double the benefit.

It’s one of the rare opportunities where the government rewards you for being responsible with your savings.

✅ The Bottom Line

If you’re retired but still earning even a modest income — and you’re contributing to a retirement account — don’t miss out on the Saver’s Credit. It’s a hidden gem that can shrink your tax bill and stretch your savings.

Check your income, contribute to your IRA or 401(k), and use Form 8880 when you file your taxes. A little planning now could save you hundreds later.

📘 Want more retirement tax tips?

Check out my book:

Tax Loopholes Just for Seniors: 33 Ways to Slash Your Taxes Right Now,

Available at Amazon.com in paperback and eBook formats.

⚠️ Disclaimer

This post is for informational and educational purposes only. It is not intended as tax, legal, or financial advice. Always consult a certified tax professional or financial advisor regarding your specific situation. The author is not a CPA or licensed financial advisor. Tax laws may change and eligibility rules may vary based on your filing status and income.