How adjusting your retirement spending can help you preserve income and avoid running out of money

When it comes to retirement, the biggest question for many people is:

“How much can I safely spend without running out of money?”

The traditional 4% rule offers a simple answer—but in today’s unpredictable markets and longer life spans, rigid rules may not be enough.

That’s where dynamic withdrawal strategies come in.

Instead of withdrawing a fixed amount year after year, a dynamic approach allows you to adjust your spending based on market performance, portfolio returns, and your evolving needs—offering more flexibility, sustainability, and peace of mind in retirement.

Let’s explore how this approach works and why it may be the smartest way to manage your money in retirement.

✅ Why Static Withdrawal Plans Fall Short

The 4% rule, introduced in the 1990s, assumed:

- A 30-year retirement

- A 60/40 stock/bond portfolio

- A fixed annual withdrawal, adjusted for inflation

While helpful as a starting point, it doesn’t account for:

- Market downturns early in retirement (which can permanently reduce your savings)

- Longevity risk (living longer than expected)

- Changing spending needs (you may spend more early in retirement and less later)

- Variable investment returns

The result? Some retirees may overspend early and run out of money, while others underspend out of fear and miss out on experiences they could afford.

A dynamic strategy adapts to the real world.

✅ What Is a Dynamic Withdrawal Strategy?

Dynamic withdrawal strategies flex with your circumstances. Instead of blindly sticking to a fixed amount, you adjust based on:

- Market performance

- Your portfolio’s current value

- Age or remaining life expectancy

- Spending needs (essential vs. discretionary)

It’s a responsive approach that helps stretch your savings while still providing the income you need.

✅ Popular Dynamic Strategies

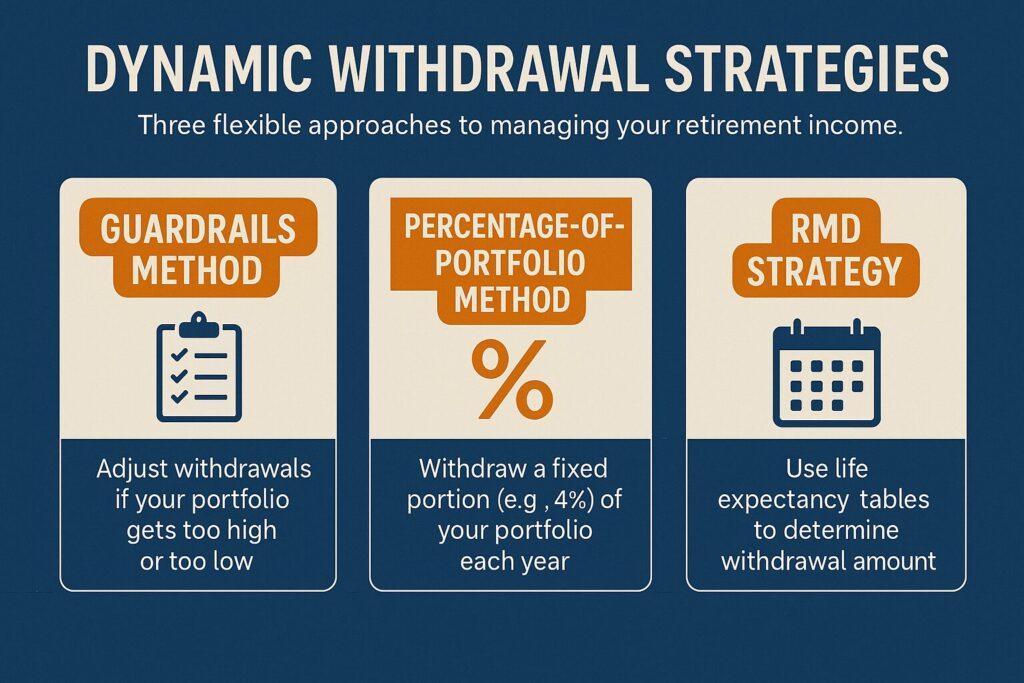

Here are three flexible withdrawal methods you can consider:

🔄 1. The Guardrails Method (Guyton-Klinger Rules)

This strategy sets a target withdrawal rate (e.g., 4%) but allows for adjustments based on portfolio growth or shrinkage.

- If your portfolio rises significantly, you can increase withdrawals

- If it drops below a set “guardrail,” you reduce spending to protect your nest egg

- Limits are placed to avoid drastic changes year to year

✅ Why it works: It creates a “cushion” for bad markets while allowing spending to rise in good years.

📉 2. Percentage-of-Portfolio Method

Withdraw a fixed percentage (e.g., 4–5%) of your portfolio’s current value each year.

- Income rises or falls with your portfolio

- You’ll never fully run out of money

- Works well for retirees with flexible budgets

✅ Why it works: It ensures you never deplete your savings entirely, even if income fluctuates.

🎯 3. Required Minimum Distribution (RMD) Strategy

Use IRS RMD tables—even before age 73—as a guide to how much to withdraw annually.

- Adjusts based on age and portfolio size

- Withdrawal percentage increases as you age

- Aligns with how long your money is expected to last

✅ Why it works: It provides a built-in mechanism to manage longevity risk.

🧓 Real-Life Example: Ken and Sharon’s Flexible Plan

Ken and Sharon retired with $800,000 in savings and planned to withdraw 4% per year. But when a bear market hit in year 2, they switched to the guardrails method, reducing spending slightly during the downturn.

When markets recovered, they increased spending modestly and even took a dream vacation.

By adjusting instead of panicking, they protected their portfolio while still enjoying their retirement.

✅ Tips for Success with a Dynamic Strategy

- Separate needs vs. wants. Cover essentials with guaranteed income (like Social Security), and adjust discretionary spending as needed.

- Revisit your plan annually. Look at your portfolio value, spending needs, and health.

- Be conservative early on. Protect against early losses (known as sequence of returns risk).

- Work with a financial advisor. A pro can help you set smart guardrails and adjust wisely.

✅ The Bottom Line

In today’s retirement landscape, flexibility is key.

Dynamic withdrawal strategies give you the power to:

- Spend confidently

- Adapt to changing markets

- Protect against longevity risk

- Preserve your lifestyle over the long haul

The future is uncertain—but your plan doesn’t have to be. A flexible approach can help you make the most of your savings without sacrificing peace of mind.

⚠️ Disclaimer

This post is for educational and informational purposes only. It is not intended as financial, investment, or tax advice. All investing involves risk, including the possible loss of principal. Please consult a qualified financial advisor before making retirement or withdrawal decisions. The author is not a licensed investment professional.