A smarter blend of stocks, bonds, and alternatives for a more resilient retirement portfolio.

For decades, the 60/40 portfolio (60% stocks, 40% bonds) was considered the gold standard for long-term investing—especially for retirees.

But times have changed.

Bonds don’t offer the same income they once did. Stocks can be more volatile than ever. And today’s retirees face a new set of challenges: inflation, longer life spans, market shocks, and unpredictable interest rates.

That’s where the 40/40/20 approach comes in.

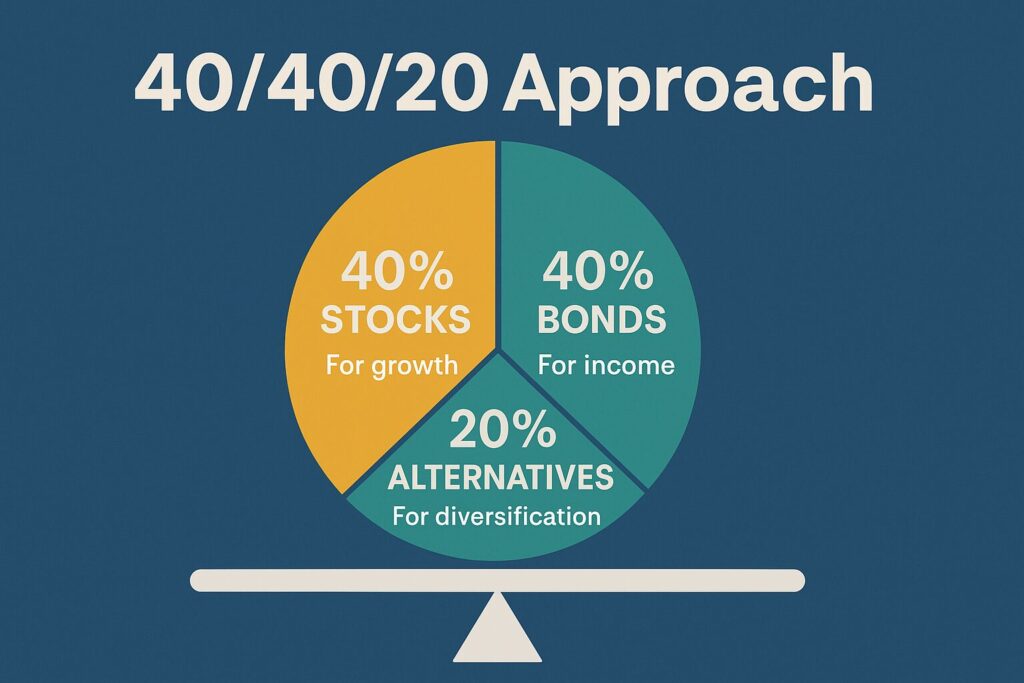

This modern take on asset allocation rebalances your portfolio into:

- 40% stocks for long-term growth

- 40% bonds for income and stability

- 20% alternatives for diversification, yield, and inflation protection

It’s a simple yet powerful way to build a resilient retirement portfolio—one that can adapt to today’s realities without taking unnecessary risks.

✅ Why Move Beyond the 60/40 Model?

The 60/40 model assumes:

- Bonds will always provide sufficient income

- Stocks will deliver strong, consistent returns

- Markets will behave predictably over time

But recent years have proven otherwise. We’ve seen:

- Bonds drop alongside stocks during inflationary periods

- Increased volatility in global markets

- Interest rate uncertainty

- Retirees seeking more monthly income and less reliance on stock appreciation

By adding alternative assets, you gain exposure to income-producing strategies that don’t move in lockstep with stocks or bonds.

✅ Breaking Down the 40/40/20 Allocation

Let’s look at each slice of the pie and why it works:

40% Stocks: Growth Without Overexposure

This slice still does the heavy lifting for long-term growth. But instead of loading up on volatile sectors, retirees can focus on:

- Low-volatility ETFs (like USMV or SPLV)

- Dividend growth stocks

- Blue-chip equity funds

These equity choices offer stability, income, and smoother performance over time—without abandoning the market altogether.

40% Bonds: Income and Downside Protection

Bonds still play a critical role, especially:

- Short-duration bond ETFs (less interest rate risk)

- Municipal bonds (for tax-free income)

- Treasury ladders (predictable, staggered income)

While yields have improved, it’s more important than ever to diversify within bonds—across durations, sectors, and credit quality.

20% Alternatives: The Income and Resilience Boost

This is where the 40/40/20 model stands out. Adding alternative assets gives you:

- More income

- Lower correlation to stocks and bonds

- Inflation resistance

Examples include:

- REITs (Real Estate Investment Trusts) – for steady income and hard-asset exposure

- Private Credit – high-yield loan funds, often yielding 8%+

- Farmland or Timber ETFs – real-world assets with low volatility

- Preferred stocks – hybrid securities that act like income-generating bonds

- Closed-end funds (CEFs) – for enhanced yields and monthly distributions

With alternatives, you’re adding real diversification—not just more of the same.

🧓 Real-Life Example: Frank and Maria’s Retirement Pivot

Frank and Maria, both in their early 70s, were using a traditional 60/40 portfolio but were frustrated by the bond performance and stock market swings.

They rebalanced using a 40/40/20 approach:

- 40% in dividend-paying ETFs and low-volatility stocks

- 40% in laddered Treasuries and short-term bond funds

- 20% in REITs, preferred shares, and a farmland ETF

The result? More stable income, better diversification, and fewer sleepless nights.

✅ The Bottom Line

The 40/40/20 approach is a modern answer to an outdated formula.

By blending:

- Growth from stocks

- Stability from bonds

- Income and inflation protection from alternatives

…you can build a retirement portfolio that’s more balanced, better protected, and more aligned with today’s financial landscape.

It’s not about being aggressive—it’s about being adaptive.

⚠️ Disclaimer

This content is for informational and educational purposes only and is not intended as financial, investment, or tax advice. All investments involve risk, including the possible loss of principal. Always consult with a licensed financial advisor before making investment decisions. The author is not a registered investment advisor and does not offer personalized investment guidance.