Accessible ways to earn steady, floating-rate income in retirement

If you’re a retiree searching for dependable income with a layer of protection from rising interest rates, senior loans could be a valuable addition to your portfolio.

Senior loans—also called leveraged loans or floating-rate loans—are typically issued by corporations and ranked at the top of the capital structure. That means in the event of a default, they’re first in line to be repaid, ahead of bonds and stockholders.

Even better? Many senior loans come with floating interest rates, making them attractive when interest rates are rising.

In this post, we’ll explore how to access senior loan income easily through ETFs and closed-end funds (CEFs), and we’ll highlight some of the top options that offer yields of 7–8% or more—without the complexity of managing individual loans.

✅ Why Senior Loans Are a Smart Income Tool

Senior loans offer several benefits for retirees:

- Higher yields than traditional bonds

- Floating interest rates, which adjust upward as rates rise

- Priority status in the event of borrower default

- Low correlation with stocks and long-term bonds

While they carry some credit risk (since they’re often issued by below-investment-grade borrowers), the secured nature of the loans provides a cushion not found in unsecured bonds or common stock.

For retirees focused on monthly income and risk mitigation, senior loans offer a compelling mix.

✅ Easy Ways to Add Senior Loan Exposure

Rather than buying individual loans (which isn’t practical for most investors), you can gain exposure through ETFs and closed-end funds. Here are some accessible options to consider:

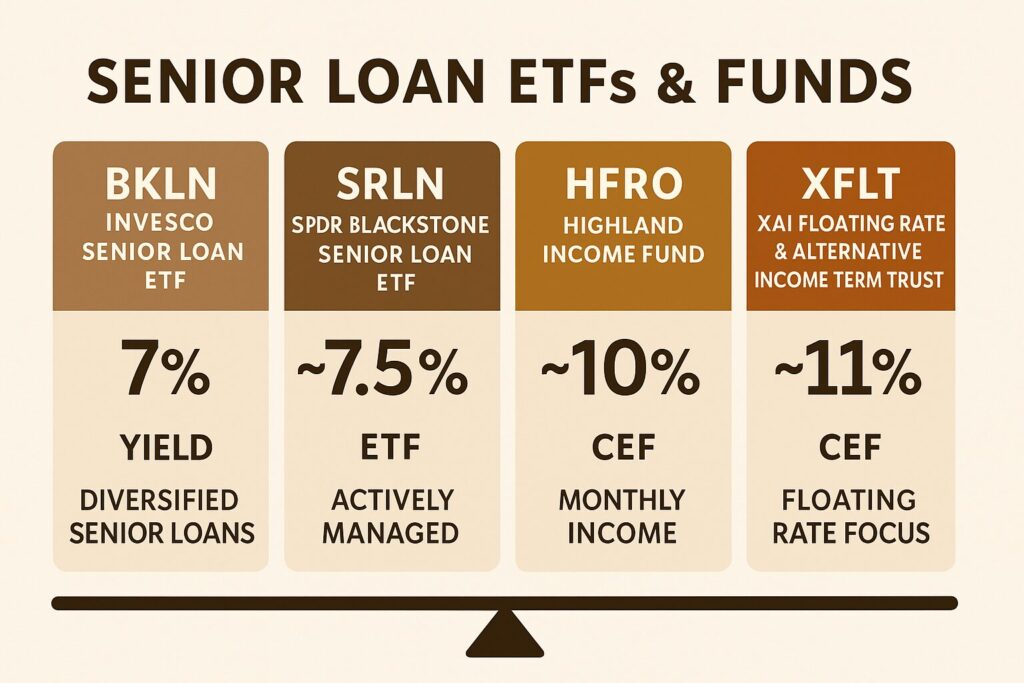

1. Invesco Senior Loan ETF (Ticker: BKLN)

- Yield: ~7%

- Type: Exchange-Traded Fund (ETF)

- Why it’s a good choice:

BKLN is one of the most liquid senior loan ETFs. It holds a diversified portfolio of senior secured loans issued by large U.S. companies. With a low expense ratio and daily liquidity, it’s a great starting point for retirees wanting floating-rate exposure without leverage or complex risk.

2. SPDR Blackstone Senior Loan ETF (Ticker: SRLN)

- Yield: ~7.5%

- Type: Actively Managed ETF

- Why it’s a good choice:

Managed by Blackstone Credit, SRLN gives you access to actively selected senior loans with strong credit quality controls. Its floating-rate focus helps protect against inflation and rising interest rates—perfect for today’s economic environment.

3. Highland Income Fund (Ticker: HFRO)

- Yield: ~10% (monthly)

- Type: Closed-End Fund (CEF)

- Why it’s a good choice:

This fund invests in a mix of senior loans and alternative income assets. HFRO offers higher income than ETFs but uses some leverage, which can enhance returns (and risk). It’s suitable for retirees looking for strong monthly income and comfortable with CEF dynamics.

4. XAI Floating Rate & Alternative Income Term Trust (Ticker: XFLT)

- Yield: ~11%

- Type: Closed-End Fund (CEF)

- Why it’s a good choice:

XFLT blends senior loans with CLOs (collateralized loan obligations), giving you exposure to diversified, income-producing credit assets. It’s actively managed and has delivered reliable monthly income. Many income investors appreciate its balance between yield and risk.

✅ CEFs vs. ETFs: What’s Right for You?

- ETFs like BKLN and SRLN are easy to buy and sell, with lower fees and no leverage. They’re great for conservative investors who want to keep things simple.

- CEFs like XFLT and HFRO often pay higher yields and distribute income monthly. However, they can be more volatile due to the use of leverage and may trade at premiums or discounts to NAV.

📌 Tip: Combine an ETF with a high-quality CEF to balance income and risk.

✅ Real-Life Example: How Frank Uses Senior Loans for Income

Frank, a 74-year-old retiree, was worried that rising interest rates would hurt his bond portfolio. His advisor recommended adding senior loans through BKLN and a small allocation to XFLT for higher monthly income.

Today, Frank earns over $700/month in income from this portion of his portfolio, with much less sensitivity to rate changes.

“It’s steady income,” Frank says, “and I don’t worry as much about the Fed anymore.”

✅ The Bottom Line

Senior loan ETFs and funds offer a smart way to generate 8–10% income in retirement, with less interest rate risk and greater security than many junk bonds.

Look for:

- Diversification

- Actively managed strategies

- A blend of ETFs and closed-end funds

- Yield supported by high-quality, senior secured assets

With a little research and the right mix, senior loans can become a stable, income-producing engine in your retirement plan.

📘 This post is adapted from my book:

The 8% Solution: Double Your Retirement Income With High-Yield Closed-End Funds,

Available now at Amazon.com in paperback and eBook formats.

Inside, you’ll discover how to combine senior loans, REITs, BDCs, and preferreds to build a reliable income stream you won’t outlive.

⚠️ Disclaimer

This content is for informational and educational purposes only and does not constitute financial, investment, or tax advice. All investing involves risk, including loss of principal. Consult a qualified financial advisor before making investment decisions. The author is not a registered financial professional and does not offer personalized investment advice.