How to Make Safer Bond Investments With Confidence

When you invest in bonds, you’re essentially lending money—either to a government or a company. And just like you’d want to know if a borrower is trustworthy before handing over a loan, you should want to know how reliable a bond issuer is before investing your money.

That’s where bond ratings come in.

Think of them like credit scores for institutions. These ratings tell you how likely it is that you’ll get your money back—with interest. Understanding what these ratings mean can help you avoid unnecessary risk and invest with confidence.

What Are Bond Ratings?

Bond ratings are issued by credit rating agencies like Moody’s, Standard & Poor’s (S&P), and Fitch Ratings. These agencies assess the financial strength of a bond issuer and assign a letter-based grade that reflects the issuer’s ability to pay back the debt.

Each agency uses a slightly different format, but the general idea is the same:

- The higher the rating, the lower the risk (but also typically a lower return).

- The lower the rating, the higher the risk (and possibly a higher return—but with more chance of trouble).

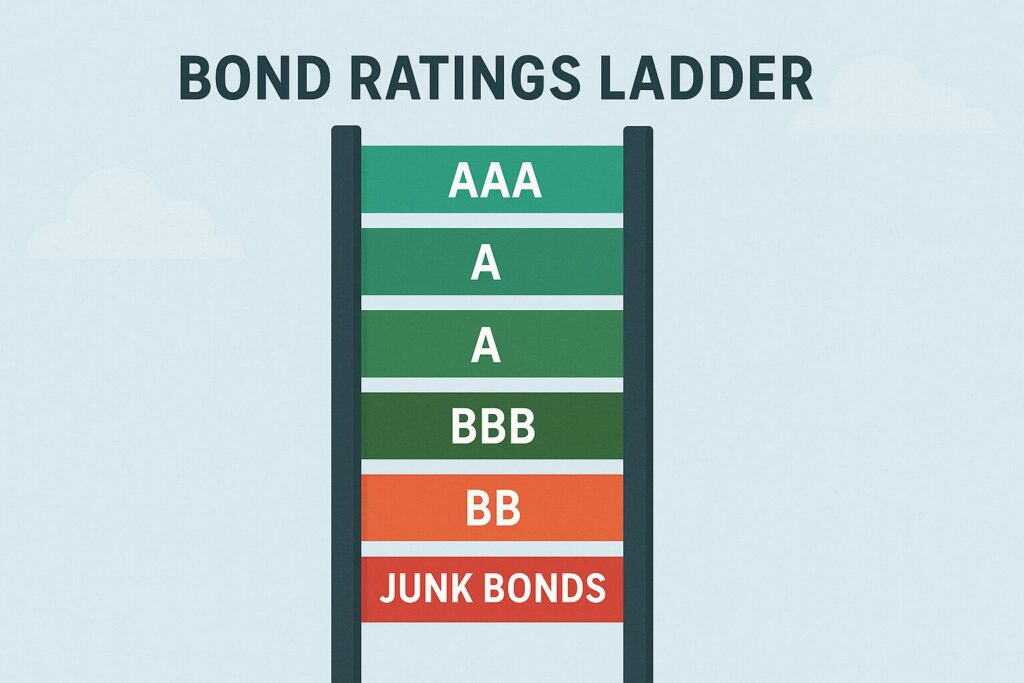

The Bond Ratings Ladder

Let’s break down the basic categories:

Investment Grade (Safer Bonds)

These are considered solid, reliable investments. Suitable for retirees and conservative investors.

- AAA (Triple-A) – The highest rating. Extremely safe. Issued by governments or very stable corporations.

- AA – Very strong, but slightly more risk than AAA.

- A – Strong, but more susceptible to economic changes.

- BBB (or Baa3 for Moody’s) – Still considered investment-grade, but the lowest rung on the ladder.

These are the bonds you can count on for steady income and high reliability.

Non-Investment Grade (Junk Bonds or High-Yield Bonds)

These bonds offer higher interest rates, but they come with a big caveat: much more risk. They may be issued by companies with shaky finances or uncertain prospects.

- BB, B, CCC, CC, C, D – The further down the alphabet, the greater the chance the issuer may default.

These may sound tempting because they offer higher yields, but they can be like picking up pennies in front of a steamroller—especially dangerous for retirees depending on income.

Why Bond Ratings Matter for Retirees

When you’re living off your savings in retirement, the last thing you want is a surprise loss from a bond that goes bust.

Bond ratings allow you to:

- Filter out risky investments before you buy

- Understand the trade-off between yield and risk

- Build a stable, income-producing portfolio

The goal in retirement isn’t to chase the highest returns—it’s to avoid unpleasant surprises. Bond ratings help make that possible.

How Bond Ratings Protected Retirees During the 2008 Crisis

Let’s take a quick look back.

During the 2008 financial crisis, many high-yield (junk) bonds defaulted as companies went under. But retirees who stuck with investment-grade bonds—especially those rated A or better—were largely protected from severe losses.

A retiree who owned AAA-rated U.S. Treasuries or municipal bonds might have lost a bit of value on paper but still received regular income and got all their principal back at maturity.

On the other hand, retirees who reached for yield and invested in CCC-rated corporate bonds might have seen defaults, frozen interest payments, or even complete losses.

Don’t Buy Blind: Know Before You Invest

Before buying a bond or bond fund, ask:

- What’s the average credit rating of the holdings?

- Is the fund focused on high yield or investment-grade bonds?

- What happens to these bonds in a recession?

Don’t hesitate to look up bond ratings yourself. Morningstar, FINRA’s Bond Center, or even your brokerage platform often lists the average credit rating for funds and ETFs.

Real-Life Example: Joe and Linda’s Bond Choices

Joe and Linda, a retired couple in their early 70s, wanted to generate safe income. Their advisor presented two bond funds:

- Fund A had an average rating of AA and paid 4% interest.

- Fund B had an average rating of B and paid 7.5%.

At first glance, Fund B looked tempting—who wouldn’t want nearly double the income? But after learning that Fund B held risky corporate bonds and had a history of sharp losses during downturns, Joe and Linda chose Fund A for its safety and predictability.

Even when the market dropped the following year, Fund A kept paying. Fund B? It slashed its payout and lost 15%.

The lesson? Ratings helped them dodge a bullet.

What About Municipal Bonds?

Municipal bonds—issued by state and local governments—are often rated as well. These can be a great choice for retirees because:

- They’re often exempt from federal taxes

- Many are rated A or better

- Default risk is typically low

However, even municipal bonds carry some risk. Look for bonds or muni bond funds with an average rating of A or above for the best balance of safety and return.

Tips for Retirees Using Bond Ratings

- Stick to investment grade. Especially BBB or higher.

- Use bond ratings as a filter, not your only decision-making tool.

- Beware of “too good to be true” yields—they usually are.

- Diversify across issuers, industries, and maturities.

- Check bond ratings periodically, especially if you’re holding individual bonds long term.

Key Takeaways

- Bond ratings are like credit scores—they help you judge risk before you buy.

- AAA, AA, and A-rated bonds are ideal for retirees seeking safety and income.

- BBB is still investment grade but requires a little more caution.

- Junk bonds (BB and lower) can be tempting, but they’re usually not worth the risk in retirement.

- Always know the bond ratings in your portfolio—and make sure they match your comfort with risk.

Final Thoughts

Understanding bond ratings is one of the simplest ways to protect your retirement savings. You don’t need to be a financial expert—you just need to know what those letters mean and how they impact your future income.

When in doubt, go up the ladder. In retirement, safety and predictability are your best friends.

This post is excerpted from my book: Retirement Income Machine: How to Invest in Bonds for Steady Income, available now at Amazon.com in paperback and eBook formats.

Disclaimer: This blog post is for educational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.