Understand what’s covered, what’s not—and how to prepare for the gaps

Medicare is a lifeline for millions of older Americans. If you’re 65 or older, chances are you count on it to help cover your healthcare costs in retirement. But while Medicare offers essential protection, it’s not a blank check—and many retirees are surprised to learn what it doesn’t cover.

In this blog post, we’ll break down exactly what Medicare does—and doesn’t—pay for, and show you how to prepare so that gaps in coverage don’t derail your retirement budget or peace of mind.

✅ What Medicare Does Cover

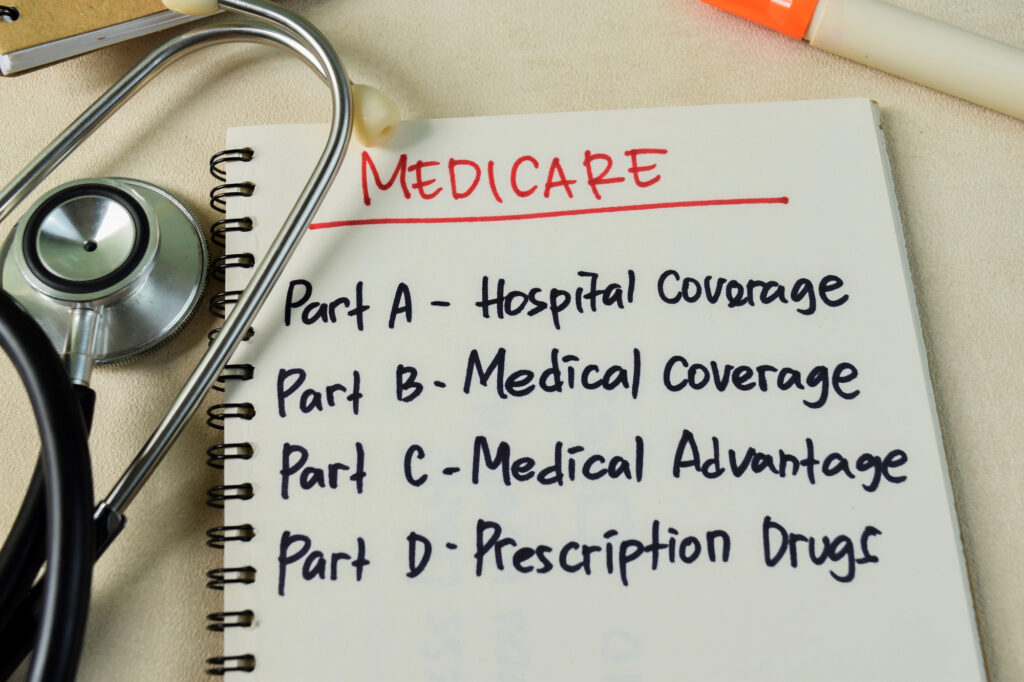

Medicare has four parts, each covering specific services:

1. Medicare Part A – Hospital Insurance

Part A covers:

- Inpatient hospital stays

- Skilled nursing facility care (after a qualifying hospital stay)

- Hospice care

- Limited home health care

Most people don’t pay a premium for Part A if they or their spouse paid Medicare taxes while working.

2. Medicare Part B – Medical Insurance

Part B covers:

- Doctor visits

- Outpatient care

- Preventive services (like flu shots and screenings)

- Durable medical equipment (like walkers or oxygen tanks)

- Some home health services

You do pay a monthly premium for Part B (most retirees in 2025 pay around $175/month, though it varies by income).

3. Medicare Part D – Prescription Drug Coverage

Part D plans (sold by private insurers) help pay for:

- Prescription medications

- Vaccines not covered under Part B

Costs vary by plan, and you’ll usually pay premiums, copays, and possibly a deductible.

4. Medicare Advantage (Part C) – All-in-One Option

Medicare Advantage plans bundle Parts A and B (and usually Part D) into a single plan through a private insurer. Many offer:

- Dental, vision, and hearing coverage

- Gym memberships

- Care coordination services

However, you may be restricted to a network of providers, and out-of-pocket costs can vary significantly.

❌ What Medicare Does NOT Cover

Here’s where many retirees run into trouble—because these uncovered items can be costly:

1. Long-Term Custodial Care

Medicare doesn’t pay for:

- Assisted living

- Help with daily activities (bathing, dressing, eating)

- Nursing home care beyond short-term rehab

Fact: Long-term care is one of the biggest out-of-pocket expenses in retirement, and Medicare simply doesn’t cover it unless it’s skilled nursing after a qualifying hospital stay.

2. Most Dental Care

Medicare does not cover:

- Routine cleanings

- Fillings, crowns, or dentures

- Oral surgery unless related to a covered procedure

Some Medicare Advantage plans offer limited dental coverage, but it may not be comprehensive.

3. Vision and Hearing Services

Original Medicare does not cover:

- Routine eye exams or glasses

- Hearing aids or exams for fitting them

Again, Advantage plans may offer this, but benefits vary.

4. Overseas Medical Care

Planning an overseas trip? Be careful—Medicare generally does not cover:

- Medical treatment outside the U.S. (with very limited exceptions)

You may want to purchase travel medical insurance or a Medigap plan with foreign emergency care benefits.

5. Prescription Drug Gaps

Even with Part D, you may:

- Face deductibles and copays

- Enter the “donut hole” (a temporary limit on what the plan pays)

- Need to pay full price for drugs not on your plan’s formulary

💡 How to Fill the Gaps

So how do you protect yourself from the costs Medicare doesn’t cover?

1. Supplement with a Medigap Policy

Also called “Medicare Supplement” insurance, Medigap plans:

- Cover some or all of your out-of-pocket costs (like deductibles and coinsurance)

- Let you see any provider that accepts Medicare

They don’t include drug coverage, so you’ll need to pair one with a Part D plan.

Note: You must enroll during your Medigap open enrollment period (first 6 months after enrolling in Part B) to avoid underwriting.

2. Explore Medicare Advantage

Some retirees prefer Medicare Advantage for its:

- Simpler bundled coverage

- Potential for extras (like dental/vision)

- Often lower upfront premiums

Just be aware of provider networks and potential high out-of-pocket caps.

3. Plan for Long-Term Care

Since Medicare doesn’t cover custodial care, consider:

- Long-term care insurance (get quotes in your 50s or early 60s)

- A hybrid life + long-term care policy

- Saving specifically for potential care needs

- State Medicaid planning, if applicable

4. Use Preventive Services

Medicare covers many free preventive services:

- Annual wellness visit

- Screenings (mammograms, colonoscopy, diabetes, etc.)

- Vaccinations

Staying on top of these can help avoid bigger bills down the road.

5. Use Drug Discount Programs

Even with Part D, costs can be high. Consider:

- Manufacturer discount programs

- GoodRx or other discount cards

- Mail-order pharmacies

- Asking your doctor for generics

🧾 Real-Life Example: Janet’s Surprise Dental Bill

Janet, 72, thought she was fully covered with Medicare and a solid Medigap plan. But when she needed a root canal and crown, she was shocked to discover the $2,100 cost wasn’t covered—because original Medicare doesn’t include routine dental care.

Now, she sets aside $50/month for future dental needs and switched to a Medicare Advantage plan with basic dental coverage.

💼 Real-Life Example: Sam’s Advantage Plan Worked… Until It Didn’t

Sam, 68, chose a zero-premium Medicare Advantage plan because it offered vision and hearing benefits. For a few years, it worked well—until he developed a heart issue and discovered his cardiologist was out-of-network.

Now, he’s switching to Original Medicare + Medigap to ensure broader provider access, even though the upfront premiums are higher.

🛡️ Final Thoughts: Be Proactive, Not Surprised

Medicare offers solid protection—but only if you understand its limits and plan around them. The most common and costly mistakes happen when retirees assume “Medicare covers everything.”

Here’s how to stay ahead:

- Know what’s covered and what’s not

- Choose the right plan for your health, lifestyle, and budget

- Reassess coverage annually during Open Enrollment

- Consider supplemental options for dental, vision, hearing, and long-term care

You worked hard for your Medicare benefits. With a little planning, you can make the most of them—and avoid financial surprises in retirement.

Disclaimer: This content is for informational purposes only and is not intended as legal, tax, or healthcare advice. Please consult a qualified financial advisor or licensed Medicare expert before making changes to your health coverage.