Why Chasing the Highest Dividends Can Be Risky—and What Sustainable Income Really Looks Like

Welcome to “Money Myths Retirees Still Believe”—a blog series that uncovers the hidden beliefs that can quietly sabotage your financial peace of mind.

Many retirees cling to common money myths that seem true but can lead to poor decisions, lost income, or unnecessary worry. Each post in this series explores one myth—like “cash is trash” or “I need to beat the market”—and replaces it with a smarter, simpler mindset.

If you’re retired or nearing retirement, this series will help you reassess your approach and feel more confident about your financial future.

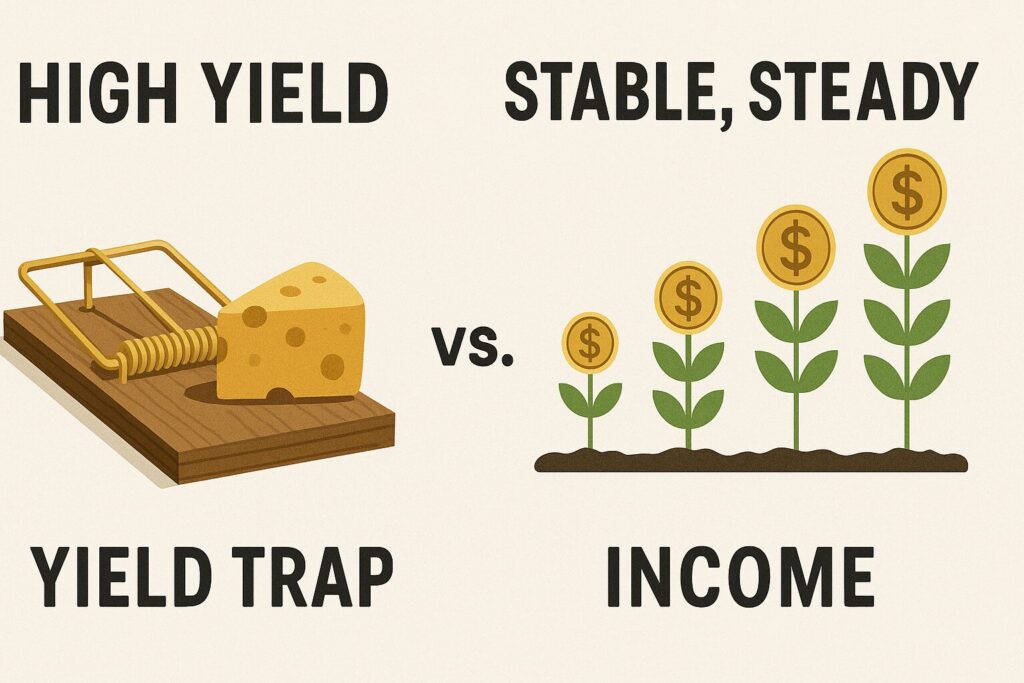

The Myth: “All I Need Is a High Yield”

When Dennis retired, he was focused on one thing: finding investments that paid the highest possible income. He filled his portfolio with dividend stocks yielding 8% or more, a few high-yield bond funds, and even some obscure monthly-paying ETFs.

“Why settle for 3% or 4%,” he asked, “when I can get 9%?”

But within two years, several of those “high-yield” investments had cut their dividends. One bond fund lost 20% of its value. And Dennis was forced to dip into his principal—something he thought he could avoid.

He’d fallen into a common trap:

👉 Believing that a high yield automatically means a good investment.

The truth? Not all income is safe income.

And in retirement, chasing yield can quietly erode the very security you’re trying to build.

Why This Myth Is So Tempting

It’s easy to understand:

- You see a fund yielding 10% and think, “That’s perfect—set it and forget it!”

- Income feels safer than selling shares

- The higher the number, the more confident you feel

But here’s the problem: High yields often come with high risk.

That 10% might come from:

- Companies in financial trouble

- Risky sectors like junk bonds or leveraged funds

- Funds that are slowly returning your own capital instead of generating real earnings

And if the income stream gets cut, you’re left with a double hit—lower income and a shrinking investment.

The Smarter Mindset: Focus on Reliable Yield, Not Just High Yield

Here’s what sustainable income actually looks like in retirement:

✅ Moderate Yields That Don’t Fluctuate Wildly

Look for dividend ETFs, preferred stock funds, and municipal bond funds that yield 3–6% consistently—not just for a few good months.

✅ Income from Diversified Sources

Instead of putting all your eggs in one high-yield basket, combine:

- Dividend-paying stocks and ETFs

- Investment-grade bonds

- REITs (Real Estate Investment Trusts)

- Maybe an annuity for guaranteed income

- A little cash for flexibility

This mix provides multiple streams that can weather different market conditions.

✅ Total Return Approach

Rather than obsessing over yield alone, think about your total return—growth + income. A fund yielding 4% and growing 4% per year may serve you better than one yielding 9% and losing 5% annually in value.

A Real-Life Example

Rhonda, a retired nurse, used to buy only high-yield stocks. But after losing money in a few risky funds, she adjusted her approach. Now she invests in:

- A dividend growth ETF (for rising income over time)

- A municipal bond ladder (for tax-free income)

- A closed-end fund that pays about 6% and has a long track record

- A small immediate annuity that guarantees a monthly paycheck

Her average yield is around 5%—but it’s reliable. And she’s not stressed when markets bounce around.

Warning Signs of a Yield Trap

Here are red flags that an investment’s high yield might not be sustainable:

- It pays a yield much higher than its peers (i.e., 10% when most pay 4%–6%)

- It uses leverage to boost returns

- It has a falling share price over time, even while paying income

- It lacks transparency about how dividends are funded

- Analysts are downgrading the stock or fund

Remember: If it looks too good to be true, it probably is.

How to Build a Reliable Retirement Paycheck

Instead of focusing on a single number, ask:

- Is this income likely to continue?

- What will happen to my income if interest rates rise or fall?

- Can this investment grow over time to help fight inflation?

- How does this fit into my bigger income strategy?

The answer might include a mix of:

- Dividend growth funds (like SCHD or VIG)

- Conservative closed-end funds (with long dividend histories)

- Bond ladders or ETFs

- Income from Social Security or annuities

- Maybe some REIT exposure for real estate income

The Takeaway

In retirement, you don’t need the highest yield.

You need the right yield—one that’s stable, repeatable, and doesn’t force you into taking more risk than you can handle.

Think of your income like a garden:

Better to grow a mix of hearty, healthy plants than rely on one fast-growing flower that might wilt in the sun.

Sustainability beats flash.

Consistency beats excitement.

And a balanced income plan beats a one-trick pony.