Why every retiree needs one—and how to choose the right person to protect your finances

As we get older, we plan for many things: retirement income, estate distribution, healthcare needs. But one essential legal tool is often overlooked—until it’s too late.

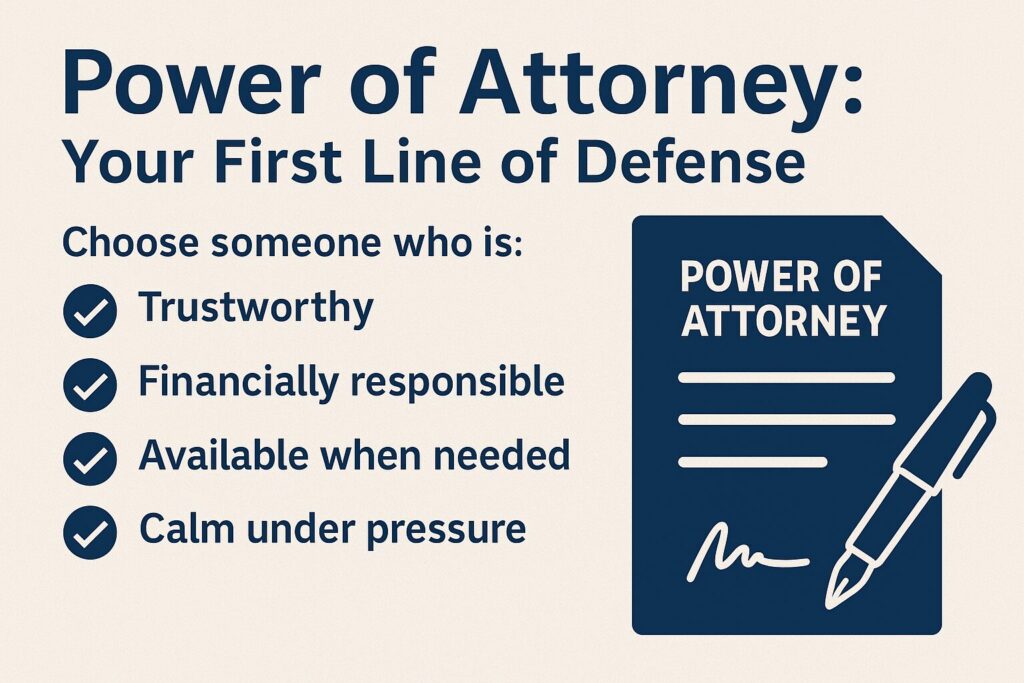

That tool is a Power of Attorney (POA). And for retirees, it may be the first and most important line of defenseagainst financial mistakes, exploitation, and the risks of cognitive decline.

In this post, you’ll learn:

- What a Power of Attorney is

- Why every retiree needs one

- How it protects your finances if your memory begins to fade

- Tips for choosing the right person to act as your agent

This isn’t just legal paperwork—it’s about peace of mind.

✅ What Is a Power of Attorney?

A Power of Attorney is a legal document that allows someone you trust to make financial decisions on your behalf if you’re unable to do so yourself.

There are different types of POAs, but the most important for retirees is a:

👉 Durable Financial Power of Attorney

This remains in effect even if you become mentally or physically incapacitated.

It allows your chosen agent to:

- Pay your bills

- Manage bank and investment accounts

- Handle insurance claims and property matters

- Prevent financial missteps if your judgment is impaired

✅ Why Every Retiree Needs One—Even If You’re Mentally Sharp Today

Cognitive decline can be subtle—and unexpected. According to the Alzheimer’s Association, 1 in 9 people over age 65 has Alzheimer’s, and many more experience mild cognitive impairment.

Without a POA in place:

- No one can legally access your accounts to help you

- Your family may be forced to go to court for guardianship

- Your finances could spiral out of control due to forgotten bills, risky investments, or scams

A POA empowers someone you trust to step in quickly and legally if you ever need help.

✅ How to Choose the Right Person

This decision matters just as much as setting up the POA itself. Look for someone who is:

- Trustworthy – above all, this person must act in your best interest

- Financially responsible – good with money and detail-oriented

- Available – ideally local, or able to manage things remotely when needed

- Calm under pressure – someone who won’t panic in a crisis

Often, retirees choose:

- A spouse

- An adult child

- A trusted relative or close friend

- A professional fiduciary (if no suitable family is available)

✅ Tip: You can name a backup agent in case your first choice can’t serve.

✅ Make It Official—Before You Need It

A Power of Attorney must be signed while you are still mentally competent. That’s why it’s so important to set it up early—before memory loss becomes an issue.

Work with an estate planning attorney to:

- Draft the document according to your state laws

- Specify the powers you want your agent to have

- Keep copies in a safe but accessible location

- Inform your agent and financial institutions

✅ Real-Life Example: When Nancy Forgot

Nancy, a 76-year-old widow, always paid her bills on time—until she started forgetting to deposit checks and left credit card balances unpaid. Her daughter, Sarah, noticed the signs and tried to help, but without legal authority, the banks wouldn’t speak to her.

Fortunately, Nancy had set up a durable Power of Attorney five years earlier. Sarah presented the document, gained access to the accounts, and protected her mother’s finances—before things got worse.

“I didn’t think we’d need it so soon,” Sarah said, “but I’m so glad we had it in place.”

✅ The Bottom Line

A Power of Attorney is not just a legal form—it’s a financial safety net.

If you’re retired or nearing retirement, setting up a durable POA:

- Protects your money

- Empowers someone you trust

- Gives your family clear direction

- Helps you avoid costly court proceedings

Don’t wait for a crisis. Put this first line of defense in place today—and gain peace of mind for the future.

📘 This post is adapted from my book:

Your Senility Portfolio: Safeguarding Your Finances When Memory Fails,

Available now on Amazon.com in eBook and paperback formats.

Inside, you’ll find real-world strategies to simplify your finances, build legal protections, and protect your savings if your memory declines. It’s the retirement guide no one wants to need—but everyone should read.

⚠️ Disclaimer

This content is for informational and educational purposes only and should not be construed as legal, financial, or medical advice. Please consult a licensed attorney or qualified financial advisor before making decisions related to estate planning or incapacity. The author is not a licensed attorney and does not provide legal services.