Your step-by-step introduction to one of the most dependable dividend stocks in the world.

If you’re new to investing or just beginning to explore how to generate steady retirement income, Brookfield Asset Management (BAM) is a great place to start. This global investment powerhouse offers something most retirees are looking for: predictable, growing income and a proven track record of long-term success.

In this beginner-friendly post, we’ll break down exactly what Brookfield is, how it makes money, how to invest in it, and why so many income-focused investors choose BAM as a core part of their retirement portfolio.

✅ What Is Brookfield Asset Management (BAM)?

Brookfield Asset Management is a global firm that manages money for large institutions like pension funds and insurance companies. They invest in real-world assets such as:

- Toll roads

- Wind and solar energy projects

- Commercial real estate

- Private credit and infrastructure

Brookfield earns income by charging management fees for overseeing these investments. This fee-based model creates steady, recurring revenue—which is exactly what you want when you’re relying on investment income in retirement.

✅ How BAM Makes Money (Without Selling Products)

Unlike companies that rely on product sales or advertising, BAM earns money from long-term contracts. Their clients pay a percentage of the assets they manage, no matter what the stock market is doing. This allows Brookfield to:

- Generate consistent profits

- Pay regular quarterly dividends

- Increase those dividends as their business grows

That’s why BAM is known as one of the safest dividend payers around.

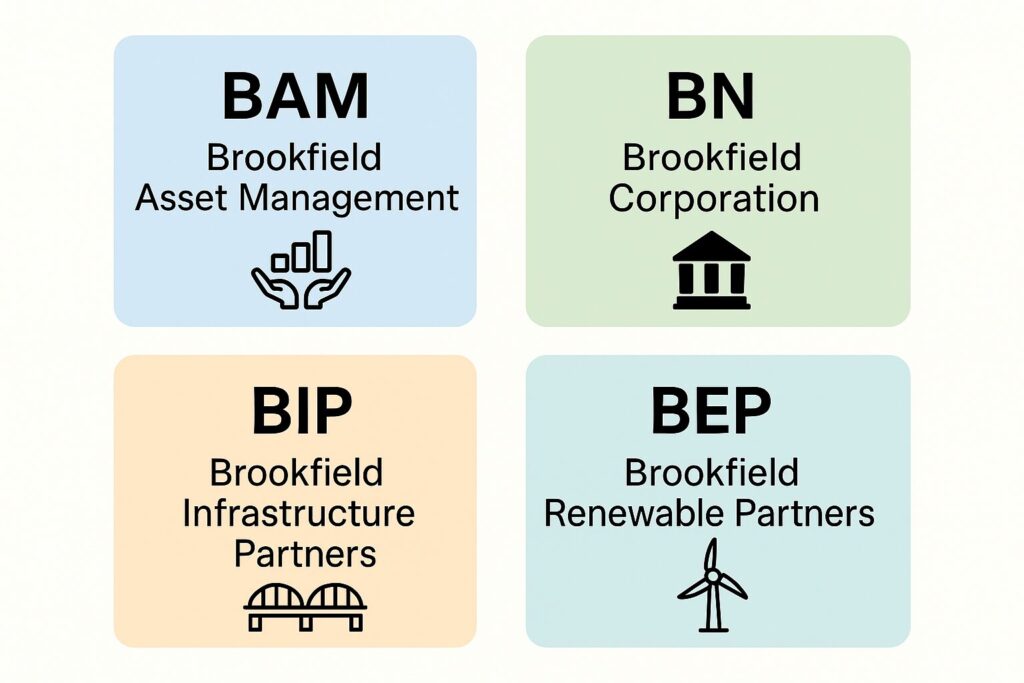

✅ Wait—What’s the Difference Between BAM, BN, BIP, and BEP?

Brookfield is part of a larger family of companies, and it’s easy to get confused by all the tickers. Here’s a quick breakdown:

- BAM = Brookfield Asset Management — the pure-play asset manager that collects fees

- BN = Brookfield Corporation — the parent company that owns a stake in BAM and other businesses

- BIP = Brookfield Infrastructure Partners — owns physical infrastructure like pipelines and ports

- BEP = Brookfield Renewable Partners — owns and operates renewable energy projects

If you’re looking for steady dividend income with global diversification, BAM is the one to focus on.

✅ How to Buy Shares of BAM (It’s Easier Than You Think)

- Open a brokerage account (Fidelity, Schwab, Vanguard, or even apps like E*TRADE)

- Search for ticker symbol: BAM

Make sure it’s listed as Brookfield Asset Management (not BN or BIP) - Decide how much you want to invest

You can start with just a few shares—or even fractional shares! - Choose your dividend preference

- Reinvest dividends to buy more shares automatically

- Or receive cash payouts every quarter to spend as income

- Buy and hold

That’s it! BAM is a long-term stock that works best when you simply own it and collect income.

✅ When and How You Get Paid

Brookfield pays dividends every quarter, typically in:

- March

- June

- September

- December

If you hold BAM in a Roth IRA or Traditional IRA, you’ll enjoy tax advantages as well.

✅ Why Retirees Love BAM

- Consistent dividend income

- Global diversification in one stock

- Simple, low-maintenance investment

- Inflation-linked growth potential

- Conservative management with a long-term focus

BAM is one of the rare companies that combines growth, income, and simplicity—making it ideal for retirees who want to stop stressing about their investments.

🛒 Want to Learn More?

This post is adapted from my book:

The Single Best Dividend Stock for Retirees, available now at Amazon.com in paperback and eBook formats.

Disclaimer

This post is for informational and educational purposes only. It is not financial, investment, or tax advice. Investing involves risk, including the potential loss of principal. Always consult a licensed financial advisor before making investment decisions. The author is not a licensed investment professional and does not provide personalized financial advice.