For decades, the 60/40 portfolio—60% stocks and 40% bonds—was considered the “gold standard” for retirement investing. It offered a balanced blend of growth and income, combining the upside potential of stocks with the stability of bonds.

But here’s the truth: times have changed, and what once worked smoothly for retirees may no longer be your best option.

Between volatile stock markets, ultra-low bond yields, and rising inflation, many investors—especially retirees—are wondering:

Is the 60/40 portfolio still relevant in today’s world?

Let’s dive into why the 60/40 model may be showing its age, what the risks are, and explore smarter, safer alternatives like an 80/20 portfolio built on low-volatility stocks and a small bond cushion.

Why the 60/40 Portfolio Was Popular in the First Place

For years, a 60/40 portfolio delivered consistent, attractive returns. Historically:

- The 60/40 portfolio averaged around 8% annual returns over the past 40 years.

- Bonds helped soften the blow during market downturns.

- Stocks delivered long-term growth to combat inflation.

It was easy to understand, easy to manage, and, for a long time, it worked well.

But the investing environment has shifted dramatically in the past two decades—and especially in the past five years.

The Problems With 60/40 Today

Let’s look at why the 60/40 portfolio is falling out of favor for retirees:

❌ Bonds Aren’t the Safety Net They Used to Be

For years, bonds provided both yield and protection. But:

- After interest rates hit historic lows post-2008, bond yields fell sharply.

- When rates finally rose in 2022, bond prices plunged—causing many bond funds to lose 10%–15% or more.

- Future bond returns are likely to be modest, especially in long-term Treasuries.

❌ Stocks Are More Volatile Than Retirees Can Stomach

In today’s unpredictable global economy, stocks have become even more volatile. Sharp swings can make retirees nervous, especially if they’re forced to sell assets in a down market.

❌ Both Can Fall Together

Traditionally, stocks and bonds moved in opposite directions. But in 2022, both stocks and bonds fell sharply, delivering one of the worst performances for the 60/40 portfolio in modern history. The old “diversification” safety net didn’t hold.

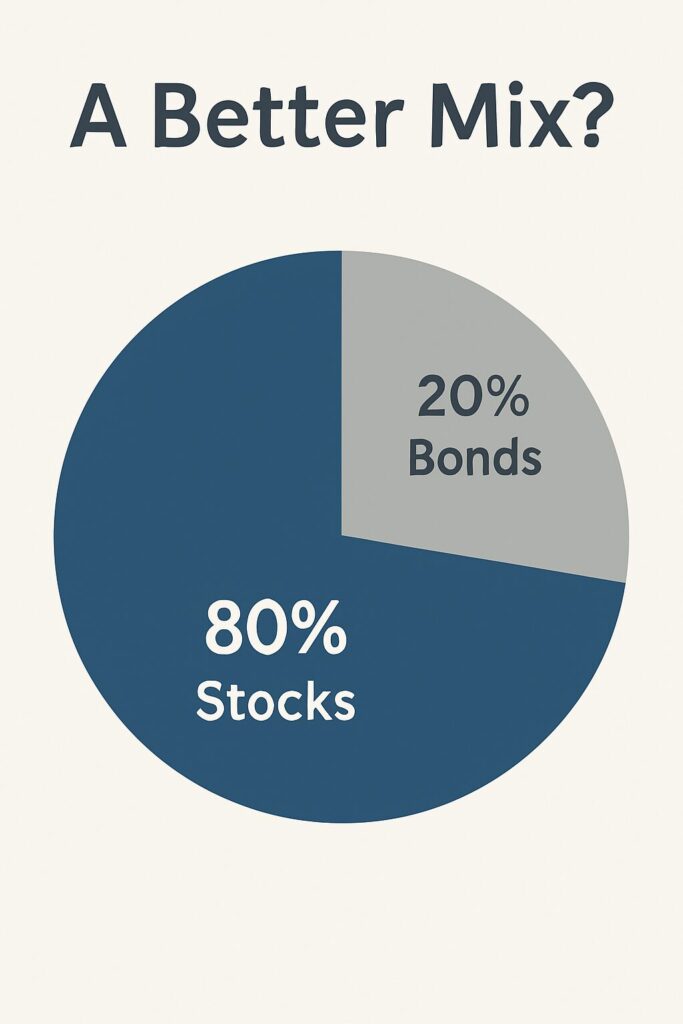

A Viable Alternative: The 80/20 Low-Volatility Portfolio

So, what’s a better approach?

For many retirees, an 80/20 portfolio made up of 80% low-volatility stocks and 20% bonds or cash equivalents may offer:

- More consistent returns

- Lower volatility

- Higher income

- Better downside protection

Let’s compare the two:

| Portfolio Type | Avg. Annual Return* | Max Drawdown (2008) | Recovery Time | Volatility |

|---|---|---|---|---|

| Traditional 60/40 | ~8.0% | -21% | 18 months | Moderate |

| 80/20 Low-Volatility | ~9.0%–10.0% | -15% or less | 9–12 months | Lower |

*Based on historical backtests of low-volatility ETF indexes (USMV, SPLV) paired with intermediate-term bonds.

Why Low-Volatility Stocks Are Ideal for Retirees

Low-volatility stocks are companies that tend to have stable earnings, consistent dividends, and less price fluctuationthan the overall market. Think of consumer staples, utilities, healthcare, and dividend-rich blue chips.

These stocks:

- Decline less during bear markets

- Offer more consistent returns

- Reduce emotional panic during downturns

In fact, low-volatility strategies have often delivered similar or better long-term returns compared to the S&P 500, but with far less risk.

Real-Life Example: Meet Jerry and Susan

Jerry and Susan are both 68 and recently retired. Like many retirees, they initially used a traditional 60/40 portfolio split between an S&P 500 index fund and a total bond market fund.

When both stocks and bonds dropped in 2022, their portfolio lost nearly 16% in one year—a gut punch they weren’t prepared for.

With help from their advisor, they shifted to an 80/20 allocation:

- 80% in a mix of low-volatility stock ETFs (like USMV and SPLV)

- 20% in short-term bonds

The results?

- Smaller losses during downturns

- More predictable monthly income from dividends

- Greater peace of mind

They now call it their “sleep-well-at-night” portfolio.

How to Build Your Own 80/20 Low-Volatility Portfolio

Here’s a simple model to get started:

Stock Portion (80%)

- 40% – iShares MSCI USA Min Vol Factor ETF (USMV)

- 30% – Invesco S&P 500 Low Volatility ETF (SPLV)

- 10% – Vanguard Dividend Appreciation ETF (VIG)

These three funds focus on stability, quality, and steady dividend growth.

Bond Portion (20%)

- 10% – Vanguard Short-Term Bond ETF (BSV)

- 10% – Fidelity Core Bond Fund or similar

These bond positions give you short-term liquidity and help smooth out volatility without locking you into long-term bonds that may lose value when rates rise.

Advantages of the 80/20 Low-Vol Strategy

✅ Reduced Market Risk

You’re not relying on volatile tech stocks or risky sectors.

✅ Higher Returns Than 60/40

Historical data shows 1–2% higher returns annually over the long term.

✅ Lower Drawdowns

Low-volatility stocks tend to decline less in bear markets.

✅ Simplified Income

Many low-vol ETFs focus on dividend-paying companies—perfect for retirees looking for steady cash flow.

✅ Fewer Moving Parts

This approach is simple to manage, even without a financial advisor.

But What About the Extra Stock Exposure?

It’s a fair concern. After all, 80% in stocks may seem aggressive—until you realize not all stocks are created equal.

Low-volatility stock ETFs are designed specifically to reduce downside risk. They’ve held up better than the overall market in past downturns, and their dividend income helps cushion the ride.

So, even though you’re technically increasing your stock allocation, you’re actually lowering the overall risk profile of your portfolio.

Final Thoughts: Time to Rethink the Old 60/40 Rule

The 60/40 portfolio had a good run. For years, it offered a simple path to growth and income. But in today’s volatile, low-yield environment, retirees need to be more strategic.

By shifting to an 80/20 portfolio built on low-volatility, dividend-paying stocks, you may enjoy:

- Higher returns

- Lower drawdowns

- More reliable income

- Greater confidence in retirement

It’s a smart, modern solution for a changing retirement landscape.

Disclaimer: This article is for informational and educational purposes only and is not intended as financial advice. Always consult a licensed financial advisor before making any investment decisions. Past performance is no guarantee of future results. All investments involve risk, including the potential loss of principal.