If you’re a retiree searching for steady income — but don’t want to take wild risks in the stock market — it’s time to explore a lesser-known but highly dependable source of retirement income: senior loans.

These floating-rate corporate loans are often tucked away in the portfolios of large pension funds and insurance companies. But increasingly, they’re becoming a favorite of income-focused retirees looking for higher yields, better protection, and less interest rate risk. Let’s explore what senior loans are, how they work, and why they’re one of the safest income-producing investments you’ve probably never heard of.

What Are Senior Loans?

Senior loans — also called bank loans or leveraged loans — are a special type of loan made to large, established companies. These loans are typically issued by banks, but they’re also bundled into funds and traded on the market, which gives regular investors access to them.

Here’s what makes them different:

- Floating-rate interest: The interest you earn on a senior loan goes up when rates rise, because it’s tied to short-term benchmarks like the Secured Overnight Financing Rate (SOFR). That makes senior loans an attractive option when interest rates are rising.

- Shorter duration: Unlike bonds, which can tie up your money for 10–30 years, senior loans usually have much shorter durations — often just a few years. That helps limit your interest rate risk.

- Secured and senior: These loans are secured by the company’s assets and sit at the top of the capital structure. That means they get repaid first — ahead of bonds, preferred stock, and common shareholders — if the company runs into trouble.

In short, senior loans are high-yielding, floating-rate loans with better protection than most other forms of corporate debt.

Why Retirees Should Pay Attention

Retirees often face a tough balancing act: they want income, but they don’t want volatility or loss of principal. Senior loans offer an appealing compromise:

- Higher income than Treasuries or CDs

- More safety than stocks or junk bonds

- Protection against rising interest rates

- Low correlation to other parts of your portfolio

For many income-seeking investors, senior loans provide a “sweet spot” of income and stability.

Floating Rates: Built for Today’s Interest Rate Climate

One of the biggest advantages of senior loans is their floating-rate structure.

When interest rates rise, bond prices tend to fall. That’s because traditional bonds pay fixed interest — and if new bonds are paying more, your older ones become less attractive. But senior loans don’t have that problem. Their interest payments adjust upward as rates rise, which helps protect your purchasing power and keeps your income stream growing.

That makes senior loans especially attractive during periods of inflation or Federal Reserve rate hikes, which we’ve seen plenty of in recent years.

Senior Loans Are “Top of the Heap” in a Crisis

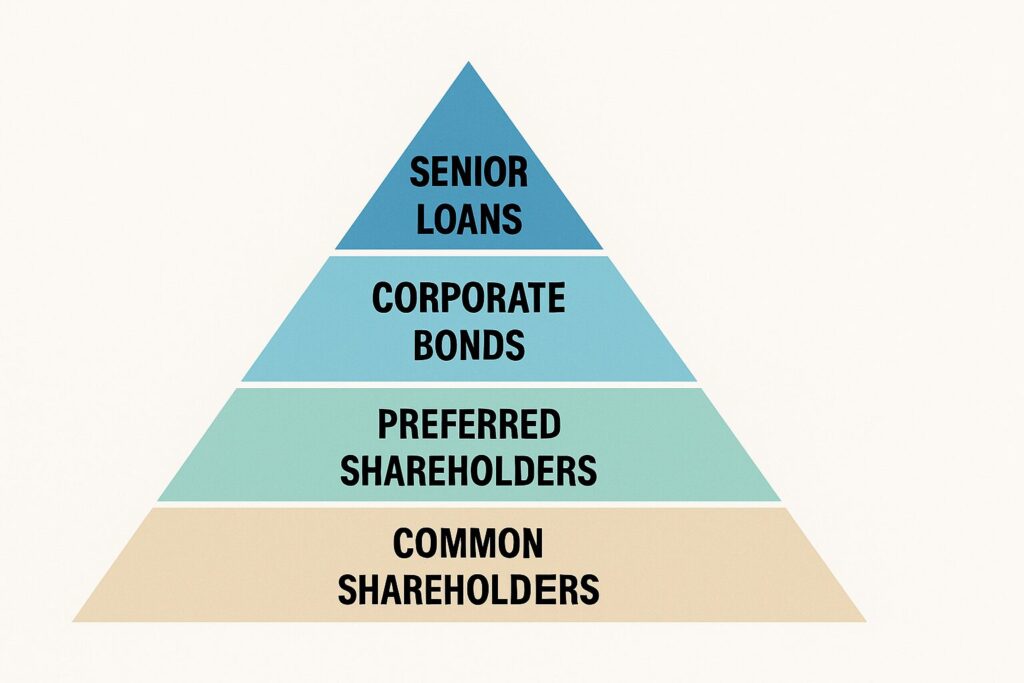

One of the most compelling reasons to consider senior loans is where they sit in a company’s capital stack.

Let’s say a company runs into financial trouble. Here’s the typical order of who gets paid:

- Senior secured loans (that’s what we’re talking about here)

- Senior unsecured bonds

- Subordinated debt

- Preferred shareholders

- Common shareholders

In this pecking order, senior loans are first in line. They are usually backed by collateral — such as the company’s equipment, inventory, or cash flow. That means investors in senior loans are often made whole even when the company fails to meet obligations to lower-ranking creditors.

In fact, according to long-term research from S&P and Moody’s, senior loans typically recover 60%–80% of their value in default scenarios — far more than bonds or stockholders, who may be wiped out entirely.

What About Risk?

Like any investment, senior loans come with risks — but they are often misunderstood.

Critics sometimes label senior loans as “junk debt,” because the companies issuing them are not always investment grade. But here’s the thing: these loans are senior, secured, and closely monitored. And most importantly, the default rate is extremely low — especially in professionally managed portfolios like closed-end funds (CEFs) or ETFs.

Experienced fund managers mitigate risk by:

- Diversifying across hundreds of different loans

- Monitoring credit risk constantly

- Rebalancing when market conditions change

- Negotiating protections in the loan covenants

According to data from Morningstar and Fitch Ratings, the average default rate in well-managed senior loan funds is typically below 2%, and many of these loans are fully recovered over time.

How to Invest: Let the Pros Handle It

Senior loans are not easy for individual investors to buy directly. They don’t trade on regular stock exchanges, and evaluating individual loans requires deep credit analysis. That’s why most retirees should consider investing through a closed-end fund (CEF) or exchange-traded fund (ETF).

CEFs, in particular, offer higher income, because they:

- Use modest leverage to boost returns

- Actively manage a portfolio of loans

- Distribute monthly income

Here are a few senior loan CEFs that have delivered reliable income:

1. Eaton Vance Floating-Rate Income Trust (EFT)

- Yield: ~9%

- Inception: 2004

- Why It’s Solid: Managed by Eaton Vance, a leader in income strategies, this fund focuses on senior loans and floating-rate debt. It pays monthly and has a long history of managing risk well.

2. BlackRock Floating Rate Income Strategies Fund (FRA)

- Yield: ~8.5%

- Inception: 2004

- Why It’s Reliable: BlackRock is one of the largest asset managers in the world. This fund holds hundreds of senior loans and uses modest leverage to enhance yield.

3. Nuveen Floating Rate Income Fund (JFR)

- Yield: ~10%

- Inception: 2003

- Why Retirees Like It: Known for aggressive yield and monthly income, this fund is popular among income-focused investors who want extra cash flow.

4. XAI Floating Rate & Alternative Income Term Trust (XFLT)

- Yield: ~11%

- Inception: 2017

- Why It Stands Out: Combines senior loans with alternative credit strategies for even higher yields. Actively managed and pays monthly.

These funds all provide an easy way to access senior loans without having to pick and monitor individual loans yourself.

Real-Life Example

Meet Jane, a 72-year-old retiree. She has a conservative portfolio but wants to earn a little more income without risking her nest egg in the stock market.

Jane puts $100,000 into a mix of FRA, JFR, and EFT. With yields between 8.5% and 10%, she’s now generating about $9,000 per year in monthly income — that’s $750 per month to help cover her bills, travel, and emergencies. And because the loans are floating-rate, her income rises when interest rates rise.

Final Thoughts

Senior loans may not be flashy, but they offer something every retiree values: income and safety.

Here’s why they deserve a spot in your retirement plan:

- They float with interest rates, helping protect you from inflation.

- They’re first in line if a company goes bankrupt.

- Their default rate is historically low.

- They provide generous monthly income through closed-end funds.

- They offer valuable diversification beyond stocks and bonds.

If you’re looking for stable, consistent income in retirement — especially during uncertain economic times — senior loans could be one of your smartest moves.

Disclaimer: For Educational Purposes Only

The content on this website is intended for general educational use and should not be considered personalized financial, legal, or tax advice. Always consult a qualified professional before making financial decisions. All investments carry risk, and past performance is not a guarantee of future results. The author assumes no liability for actions taken based on this content.